The Armor Smart cover system is live!

After the initial launch of the $ARMOR ecosystem, we’re excited to be entering the next phase of our protocol with the Armor Smart Cover system.

DeFi is wrought with risk, smart contract exploits, and bugs, keeping many individuals and institutions away from participating in the future of finance. Armor is here to help make DeFi a safer place to invest.

There is an insurance supply and demand issue, and end-users don’t have very customizable or streamlined options for coverage. With arCore Smart Cover, we provide simple-to-use, “pay-as-you-grow’’ Nexus Mutual coverage on your assets to protect against smart contract risks.

As laid out in the product roadmap in the Armor introduction, Smart Cover is connected to our arNFT staking system and will impact the $ARMOR rewards. We’ve laid out everything you need to know about both options to cover your DeFi assets, the benefits and the differences between them below.

arCore Smart Cover & arNFT staking

The revolutionary and flexible arCore Smart Cover system is made possible by arNFT staking. What arNFTs are and how you can use them is explained in detail in the second half of this article, but basically the Armor Cover systems work like this:

- arCore Smart Cover provides simple-to-use, pay-as-you-grow Nexus Mutual coverage on your assets to protect against smart contract risks.

- This is made possible through arNFT staking, which provides rewards for participants.

- These arNFTs can also be used to directly provide DeFi cover to the user.

The system allows users the option to either mint cover policies (arNFTs) for their own protection, or stake them to the Smart Cover.

If you choose to stake in the arNFT staking pool, you are effectively selling your coverage to the protocol in exchange for yield through ArCore (and are therefore no longer protected).

Rewards are earned in $ARMOR tokens as an incentive for staking coverage arNFTs. Yield is generated if the staked arNFTs are brokered to other users who purchase coverage.

The arCore users themselves also earn Armor rewards, simply for using the system.

Buying Smart Cover

Insurance is typically not very flexible — it is purchased for a fixed amount, and for a fixed period of time. With arCore Smart Cover, you can now purchase coverage for a dynamic cost for as long as you need the protection.

Smart Cover is available to protect you on any platform with enough staked arNFTs to support the purchase. For each platform, there is a separate Smart Cover pool with its own available coverage.

When you connect your wallet on https://armor.fi/protect, the arCore system will assist you by analyzing your wallet using the Zapper API.

A few seconds later you will receive a personalized proposal, based on your assets, which includes tokens and LP-positions. You can choose which of the discovered assets you want to cover and can add other assets manually as well.

The cover is perpetual; it has no end date. When you start your arCore Smart Cover plan, you must deposit ETH into your Armor account and then the total cost for your plan is streamed from your balance by the block.

Rather than paying for a fixed coverage total for a fixed period upfront, you pay for the coverage incrementally.

If changes to the assets in your wallet are detected and confirmed by you, the fee-per-second is updated automatically and a new stream begins, which will stay active as long as there is arCore credit in your account balance, which can be topped up at any time.

You can cancel your cover and withdraw any excess credit anytime without any cancellation fees; you just pay gas fees for the smart contract interactions.

Buying arNFT Cover & Staking It

What is an arNFT?

The arNFT is a non-fungible token wrapper (ERC-721) for Nexus Mutual coverage, which, when staked, enables ArCore and ArShield pay-as-you-grow coverage.

arNFT includes many security improvements over yNFT tokens and offers new functionalities and possibilities. To learn why we moved from yNFT to arNFT, read this article.

Participants can mint (buy) arNFTs and do several things with them, including:

- hold them for their own protection

- transfer them to another wallet

- sell them on the open market

- stake them to earn fees, as well as to earn rewards in $ARMOR tokens

arNFTs can be minted for every platform that Nexus Mutual covers. As the system grows, more platforms and coverage will be available. As always, detailed information about arNFT’s can be found in our Gitbook.

Selling Cover

In order to provide coverage through arCore Smart Cover, Armor requires the staking of arNFTs. These arNFTs are pooled and managed by the system, and buyers may purchase coverage up to the amount that is currently available in the pool for a certain platform.

Source of Revenue

Smart Cover pay-as-you-grow buyers are charged a premium on top of the fixed cost coverage paid by arNFT stakers. These payments will be largely distributed to arNFT stakers, earning them a yield. Additionally, select arNFTs will earn $ARMOR rewards on top of that.

Detailed economics and the maths behind them can be found here on our Gitbook, (model constants are here).

How to Buy arNFTs

You can buy arNFTs in a few simple steps:

- Visit the Armor Mint. See which platforms you can earn rewards with based on what you currently own and wish to cover.

- Click a platform with cover available that you are interested in.

- Enter the duration of the cover (30-day minimum, 365-day maximum).

- Enter how much you wish to cover. No minimum, and the maximum is limited by coverage available

Note that the “amount you want to cover” is not the cost of buying the arNFT, but the amount that will be covered by it. Depending on the risk profile of the covered platform the received cover per ETH paid for it will differ.

As minting arNFTs is relatively expensive with current gas fees, it’s advisable to acquire 1 single large arNFT than many smaller ones, as the staking itself has similar costs.

5. Click on “Get quote”

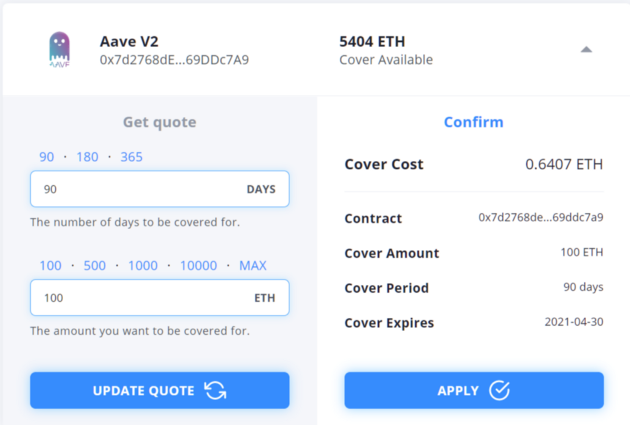

Then you will see something like this if you have chosen to protect 100 ETH worth of your AAVE deposits for 90 days:

6. If you want to change the duration or amount covered, then you can change the values and click “update quote”, so the cover costs will update accordingly.

7. If you are happy with the quote, click ‘Apply’ and a MetaMask transaction will trigger to pay the cover.

8. Once the transaction confirms, you will receive an arNFT.

You can see your arNFT in your Armor Dashboard, and you can add the custom token to your wallet as well. See our detailed guide on Gitbook.

Swapping yNFT to arNFT, Transferring and Claiming

If you already bought yNFT on Yinsure, you can migrate these to arNFT and enjoy all of the additional features and benefits. All details are here in our Gitbook, followed by instructions on how to transfer your arNFT to another wallet and how to make a claim.

arNFT Staking

Besides minting an arNFT for your own protection, you can earn rewards by staking them.

The arNFT staking vault generates yield by supplying the underlying coverage to arCore Smart Cover, where it is pooled and brokered to customers at a premium. Then the premiums are dispersed to arNFT stakers.

Stakers receive rewards as long as their arNFT is active. For example, if the arNFT has coverage for 1 year, the staker will continue to receive rewards for 1 year. The amount of rewards received over that time is determined by the stakers share in the arNFT pool for that contract and based on the premium/second for the arNFT.

Users who stake arNFTs will earn $ARMOR staking rewards and yield rewards when their staked arNFTs are being sold through the arCore system. Certain platforms might also offer additional rewards for users to stake arNFTs.

How to stake/unstake your arNFT

- Navigate to Staking Rewards and scroll to arNFT staking.

- Click stake.

- Approve the transfer via MetaMask, and then execute the stake. Approve both transactions to complete the stake.

Once staked, you will see your rewards accrue in the “Staked arNFT” table, and you may claim your rewards at any time by clicking “claim” on the Stake page.

You may withdraw your arNFTs at any time, although there is a 7-day waiting period after withdrawal is initiated.

To do this, simply click “Withdraw” in the “Staked arNFT” table.

Note 1: Staked arNFTs no longer provide coverage to the user who stakes them, as you are essentially re-selling your cover to others in exchange for rewards and fees.

Note 2: arNFTs that are being used in the arCore system, cannot be unstaked. So, if for example arCore capacity for Yearn is 75 ETH and you have staked a 50 ETH and another 100 ETH arNFT, you can unstake the former, but not the latter. Only once unused capacity is larger than the cover value of your arNFT, it can be unstaked. See also the details in the Armor Gitbook here.

As a reminder: only arNFTs eligible when you checked the gift checkbox (when you minted the arNFT on https://armor.fi/mint) can be staked for rewards.

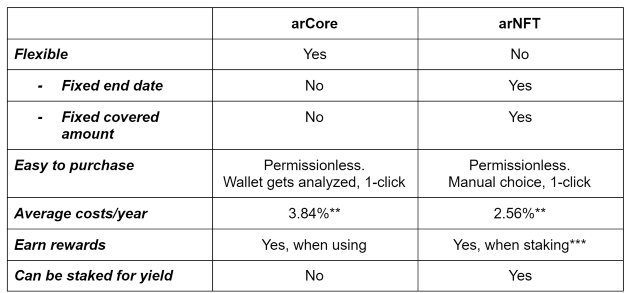

Should you choose arCore or arNFT to cover your assets?

So, with two options available*, which one should you choose to cover your valuable DeFi assets?

- The arCore Smart Cover is suitable if you have dynamic DeFi positions, i.e. they change often: either in size, value or both.

- The arNFT cover is suitable if you have a static DeFi position that you want to cover in the most economical way.

* Depending on the protocol and the staked amounts, one or both options might (temporarily) not be available due to high demand.

** The typical cost for most covered protocols. Some protocols could have different costs/year.

*** You are no longer covered yourself when staking your arNFT.

Claiming Payouts

If you lose your funds in a smart contract hack, you may claim a payout. Successful claimants will be paid for the protected coverage amount through the Armor contracts.

The Armor system detects and determines when a hack took place. The affected users are required to submit proof of loss to initiate the claims process; Armor compiles all claims along with proof of loss.

Once the hack’s timestamp has been submitted, NFTs that have been staked on the Armor contract can be submitted to Nexus Mutual.

Note: Nexus Mutual is the underwriter of coverage, and Nexus claims assessors decide all claims. Claims can only be paid out to users if approved by Nexus Mutual claims assessors according to Nexus Mutual policies, terms and conditions.

Please see all details about claiming here on the Gitbook.

We hope you find this article helpful in understanding both options to cover your DeFi assets with Armor. If you still have questions, feel free to reach out in the social channels, see below.