A very successful first month for Armor

It has been only a month since Armor.Fi launched its first ecosystem products, and already:

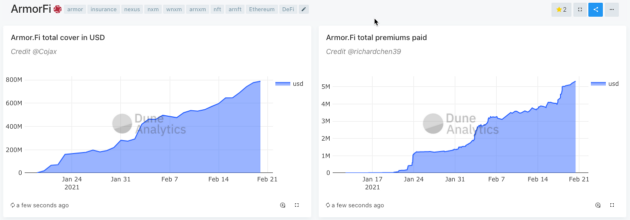

- Total coverage sold surpassed $800 million USD, pushing active Nexus Mutual coverage beyond $1 billion USD in less than a month.

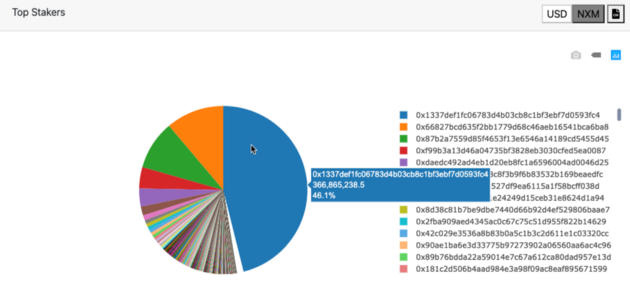

Armor’s arNXM Vault accounts for over 45% of staked NXM on Nexus Mutual. Due to significant demand, the team developed, audited and launched the arNXM V2 Vault early to expand staking capacity to cover more protocols.

- arNXM:NXM ratio has increased from 1.0 to 1.03. This translates to an APY of 47.7% annualized over the underlying asset (NXM). arNXM has several times more liquidity than wNXM on DEXes too.

- As a result of the Yearn hack, 30,273 NXM were burnt from the arNXM yield vault. Armor’s coverage for coverage providers protected arNXM vault stakers by taking on this loss as debt. 27,981 NXM has already been restored, and debt outstanding is 2292 NXM.

- ArNFT holders successfully claimed over $228k in payouts for the yearn hack

- Armor DEX liquidity pools surpassed $42m in liquidity across Sushiswap, Uniswap, 1inch and Balancer with an average of $4m in daily trading volume since launch.

- Armor follows an iterative rewards model that is optimized as better data becomes available. Based on data, observation and community feedback the $ARMOR rewards program was extended from 24 weeks to 2 years.

- Armor tracking, trading and liquidity rewards have been integrated into Zapper.fi, Zerion, DeBank and Coingecko

- The $ARMOR token hit #1 on DEXTools at launch, was added to DODO DEX, won community votes for research reports by CryptoShual and Blue Kirby, and was added to the Sushiswap Onsen so users can choose to earn rewards in $SUSHI too

- Armor launched a bug bounty program in partnership with ImmuneFi which was a huge success. Armor paid out the biggest bug bounty in Ethereum’s history, which reached a value over $1.5 million USD, and reinforced Armor’s security by fixing a critical bug.

- An $ARMOR oracle was added to Sushiquote then $ARMOR was added as collateral to Unit Protocol, a new alternative to MakerDAO, allowing users to mint the $USDP stablecoin and add it as liquidity to Component Finance.

Ecosystem growth, product performance, and community response have been impressive and the community is excited to carry forward this positive momentum.

Let’s dive into some details on what happened this month!

Armor token launch and LP-staking rewards

The $ARMOR token was minted and seed liquidity provided to leading DEXes: Uniswap, Sushiswap, 1Inch, and Balancer.

Simultaneously, liquidity staking rewards started and very soon reached over $42 million in deposits, ensuring sufficient liquidity for ETH, wBTC, and DAI pairs.

arNFTs

Armor offers tokenized Nexus Mutual coverage as arNFTs. Yearn’s Yinsure.finance is also powered by Armor.

arNFTs provide several improvements over native coverage for DeFi users:

- Permissionless coverage access

- NFTs can be transferred

- NFTs can be staked for rewards. Coverage provided by staked arNFTs is pooled by arCore Smart Cover System and brokered to end users.

Users can hold arNFTs and be protected themselves. If they no longer need this coverage, they can stake it with arCore in return for farming rewards and revshare from arCore utilization.

To launch the arCore Smart Cover System and scale to market demand, Armor needs access to arNFT’s to broker to other users. To promote participation in staking, an easy to use UX and additional incentives in the form of farming rewards have been provided. To bootstrap staking, rewards were boosted for the first few weeks.

Yearn Finance exploits and payouts

The number of platforms that have suffered a hack or exploit has grown steadily in recent years, highlighting the need for protection.

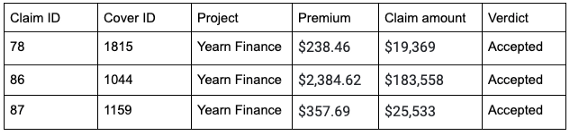

Yearn was recently affected. Nexus Mutual claims assessors decided claims should be accepted and paid out.

The following claims were successfully paid to holders of arNFTs:

Note: amounts are converted from ETH and can change, depending on the current ETH rate.

These NFTs were purchased at premiums ranging from 1.2–1.4% of the claimed amounts. This demonstrates the value of DeFi coverage to safeguard users’ assets.

The arNXM vault, V1 & V2

The arNXM yield vault accepts NXM and wNXM and swaps it for arNXM, which is a yield-bearing token. The underlying NXM are staked by Armor on Nexus Mutual for yield.This means that DeFi users can now be underwriters with Nexus permissionlessly.

Within 2 days of launch, Armor opened up $250m in Nexus Mutual coverage capacity and sold $185m worth of coverage with over $1.2m in premiums paid. Since then this has grown to $800 million in cover sold generating $5m in premiums.

Due to significant demand, the arNXM vault was updated to Version 2 early with the following changes and upgrades:

- NXM and wNXM can be deposited, although only wNXM can be withdrawn.

- The staking/unstaking will be done every 7 days; this means that the reserve will refill every 7 days.

- The reserve amount will be a static number which can be adjusted through governance (Currently 20,000).

- In addition to the original 10 protocols, it is now possible to add multiple ‘buckets’ of ten protocols each. 2 additional buckets have already been added and arNXM vault is now providing coverage capacity on 30 protocols. More buckets will be added as more deposits are received.

- The amount of NXM to stake per bucket is based on the risk rating and demand for cover. Currently, there are 3 buckets based on risk (low, medium, high), as demand metrics are unavailable. As more data becomes available, a function based on risk and demand will be defined to determine the amount of NXM to stake in each bucket to automate/simplify the staking function for the DAO.

- The buckets will be cycled in sequence for each staking/unstaking cycle. Each period, Armor will stake NXM = (holdings — reserveAmount) into the appropriate bucket; as well as unstake a set % of NXM from that same bucket, which will start the 30 day unlock period before this unstaked amount is fully unlocked.

- The vault is flexible: the order of the buckets in the cycle, and what’s in each bucket can be changed; Buckets can be blocked from automatic rotation; Unstake percents can be set individually for each protocol to enable optimization

- Anyone can call the ‘restake’ function at the end of a period, which distributes rewards to stakers.

- Getting Nexus rewards and shield mining rewards can be called by anyone and at any time. Note: Nexus releases all rewards at 0900 UTC on Mondays.

Armor staking rewards V2

Reward emissions have been restructured to a more sustainable model in the interest of long term growth of Armor.

The total amount of tokens allocated to farming remain the same; however, the farming period has been extended to 2 years instead of the original 24 weeks which is more favorable to long term community members.

Moreover, the emission rate will now decrease every week to increase scarcity, and therefore, value over time.

The new rewards model will use the following parameters:

- Emission rate of ARMOR = 1.5M tokens per week (initial, boosts not counted)

- Emission decreased by 0.51% every week over the previous week.

The new emissions model and rewards allocations have been optimized based on multi-factor sensitivity analysis (token value, liquidity, APY), and will be improved further as better data becomes available, and based on community feedback.

Strategic partners

In a detailed medium post Armor announced that Collider Ventures, Delphi Ventures, Divergence Ventures, DeFiance Capital, Alameda Research, 1kx, The LAO, Blocksync and Bering Waters Ventures have joined Armor as strategic investors.

Their insights and contribution have been essential to Armor’s mission, to help the team and community work to secure mass-scale adoption of DeFi protocols both with institutions and individuals.

Next steps

Meanwhile, the Armor team has grown. Armor has added a marketing team, new developers and community managers. The team has been working around the clock to prepare for upcoming product releases, decentralization and community development.

Soon™ the much awaited arCore Smart Cover System will be launched following multiple audit rounds, which will allow DeFi users to get Pay As You Grow smart coverage.

Also to be unveiled soon is the Armor Alliance Big Bug Bounty Challenge, which will utilize a community based approach to make DeFi safer for everyone.

Next month, Shield Vaults will be launched, which will allow DeFi users and Liquidity Providers to get automated coverage for their tokens, without upfront costs and the premiums are adjusted from their LP rewards!