Cover your DeFi assets with ease

How does ease Uninsurance work?

- Simply wrap any amount of supported DeFi tokens.

- Get perpetual coverage against hacks, scams and rug pulls.

- Enjoy auto-compounding yield.

- Pay no premiums and exit when needed.

Watch the video for more details (captions available).

Get covered, not charged: be at ease

No Premiums

No hacks?

No costs for uninsurance cover.

No Profiteers

The ease system is free of coverage underwriters that want to profit off of you.

100% Covered

You retain coverage on all protocols you’re exposed to rather than needing multiple plans for one position.

100% Backed

Uninsurance does not require leverage on your collateral, so black swan events will not bankrupt the system.

100% Flexible

Ease tokens are covered perpetually, for their full Ether value, with no fixed contracts or maintenance needed.

The Evolution of Insurance

Traditional Insurance

TradFi insurance has moved away from the idea of risk-sharing to a cashcow for insurance companies and their shareholders.

Their business model is based on profiting by charging premiums while minimizing claims payouts.

The first DeFi cover solutions were a giant step forward.

The need for profit was much lower as blockchain-based solutions were more efficient and transparent.

Still, the fact that underwriters were needed and the inflexibility of the systems were two major drawbacks.

Armor Smart Cover

Armor.fi introduced smart cover and shield vaults, the predecessors of Uninsurance.

Now, everyone could get coverage for their DeFi assets, with flexible amounts and dates, while earning yield.

Still, the system was underwritten by leveraged collateral seeking yield, paid by the DeFi users using premiums.

ease Uninsurance

ease takes all the positives and fixes the drawbacks.

Flexibility in coverage without costs. Finally everyone can get their assets covered and truly DeFi at ease.

Meet the ease team

The ease.org team is spread around the planet. Read more about ease’s mission & vision here. We are hiring!

Partners

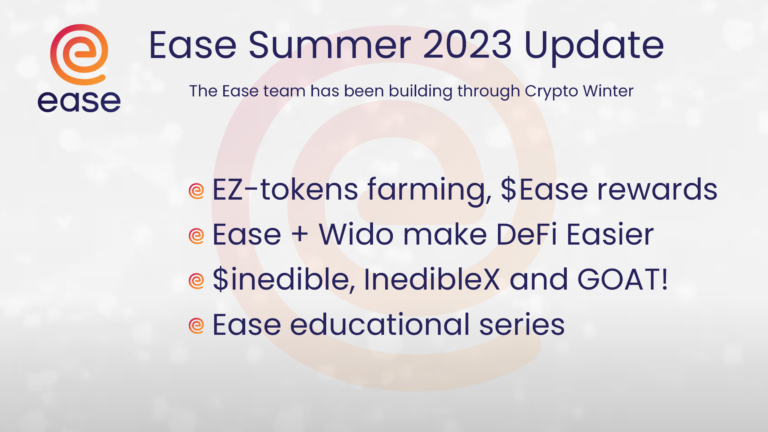

Ease Summer 2023 Update

Ease has been busy this summer So, what have we been up to during the 2023 Summer? The many global heatwaves notwithstanding, we are still in …

June Update: Ease Risk Ratings

With the end of June, we have conducted the monthly update to protocol Ease Risk ratings. Below is the summary of notable changes, or lack thereof. …

Ease: More than Coverage

Since our inception, Ease’s mission has been to make DeFi safer, by making it as easy as possible to secure your funds. With Armor, this was …

May Update: Ease Risk Ratings

With the end of May, we have conducted the monthly update to protocol Ease Risk ratings. Below is the summary of notable changes, or lack thereof. …

ease Quarterly Update: Q1 ’23

Looking back at 2022 A new year has started, and there seems to be some melting going on in the crypto winter. Whether it’s freezing or …