Unit bias is the fact that lower priced assets seem to be valued higher than an economically equivalent fraction of a higher priced one.

For example: many crypto investors flocked to Shiba and Doge “as they were cheaper than BTC and ETH”! This is Unit Bias.

What they mean is that one Unit of BTC is much more expensive than one Unit of Doge!

This is of course true, but BTC (and Doge and most other coins) can be subdivided into much smaller fractions.

- 1 BTC is divisible into 100 Million Satoshis.

- 1 Satoshi costs about $0.000234, while 1 Doge costs about $0.08.

- So 1 DOGE = 349 Satoshi = ₿0.00000349.

So, unlike BTC, Satoshis are actually much cheaper than Doge coins!

Economically it therefore doesn’t make sense to choose one token over another based on Unit price, as $100 worth of $Doge is worth exactly the same as $100 worth of BTC, but still 1168 Doge sounds a lot more than 0.004174518 BTC…

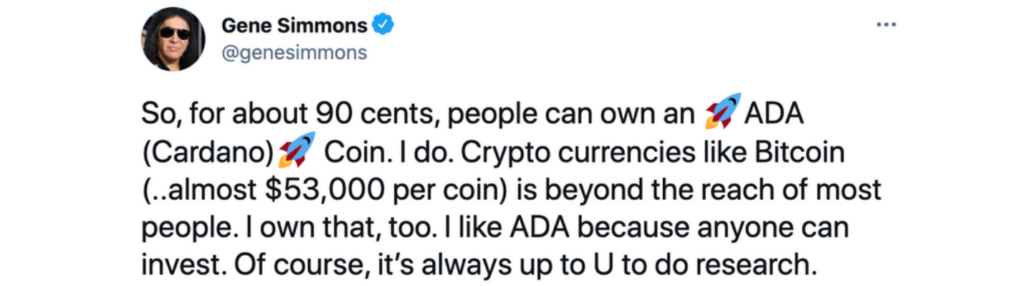

This Unit Bias was famously demonstrated by musician and crypto influencer Gene Simmons, using $ADA and $BTC as example:

Though his reasoning doesn’t make sense economically, it does psychologically and many people do think this way!

« Back to Glossary Index