Upgrade from Armor.fi to ease.org

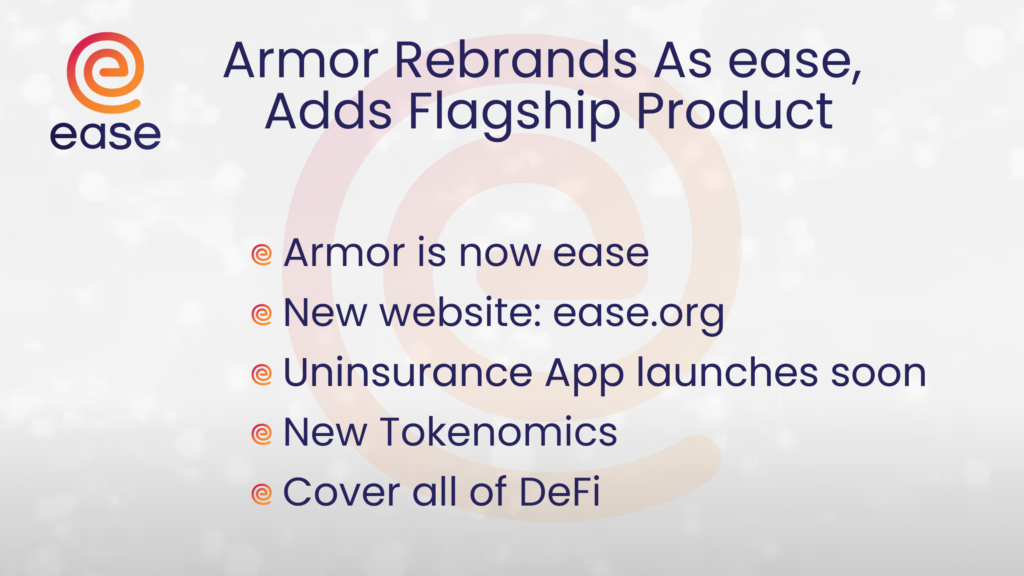

Today we announce our upgrade from Armor.fi to Ease.org. Ease does not represent a shift in our mission: it represents a shift in our strategy.

Ease’s goal is still to cover every dollar in DeFi, but we’ve realized that can only be done by making DeFi covered from the moment users enter the space. In our vision, users will barely make a thought about whether to be covered; they just will be.

With Ease we prepare for the next generation of DeFi users.

While Ease’s functionality is extremely beneficial to current DeFi users, Ease is going the extra mile to make it accessible to people intimidated by or fearful of the complication and risks involved in today’s DeFi processes.

This is why the new website also contains a lot of background info about DeFi and Crypto.

We predict Ease Uninsurance and this future generation of DeFi users will bring about a new branch of DeFi in which users are covered by default, included protocols are established and vetted, and users have no need to worry about hacks and scams.

How will Ease do this? Uninsurance!

Ease will focus specifically on Uninsurance (reciprocally-covered assets, or RCAs). Armor will retain arNFT and arNXM, but the smart cover system and shield vaults will be sunsetted to focus on our Uninsurance.

This coverage model allows users to go directly from Ether to an underlying yield-bearing token wrapped with perpetual coverage. One site, one decision, no premiums, no maintenance.

Uninsurance will:

- apply to hacks and rug pulls for every protocol the token is affected by;

- only cost exactly what it needs to;

- not rely on guessing risk;

- be extremely resilient to black swan events;

- be easy. Coverage can easily expand to more risks such as depegging.

The vaults that mint RCAs also include quality-of-life upgrades for users. Automatic staking/unstaking, compounding of rewards, bundled stacked risk. We will not be employing any of our own strategies. We will simply be streamlining the ones already employed by trusted DeFi protocols.

What’s happening to the $ARMOR token?

We are currently finishing up a new tokenomics model that takes the beneficial aspects of veTokens but increases its security and fairness. See this article on our brand new Knowledge Base.

Voting/reward power will grow as a user is in the system longer rather than power decaying after locking tokens for a certain amount of time. We call it the “Growing Vote Token,” or gvToken model.

Once finished, Ease will be opening up a token swap from $ARMOR to $EASE tokens. This is a 1:1 swap and it will be as simple as possible for users.

Users who are currently staked in $vARMOR will receive retroactive Ease voting/reward power. This is based on how long (starting today) they’ve been in the $vARMOR system by the date of the launch of our new gvToken model.

The utility of the Ease token comes not only from governance but also from Uninsurance’s safety ranking system. Protocols are ranked depending on how many tokens are delegated to them by users and/or protocols. The highest-ranking ones will be slashed less when a hack occurs.

What’s the end goal?

- Ease’s end goal is to cover all of DeFi.

- Ease will create the safest assets, and make them the easiest to use.

The ease protocol is not planning on expanding into other DeFi sectors, creating our own strategies, or on expanding into traditional insurance. Ease will create the easiest and safest way to enter the world of DeFi. Ease will put 100% of its efforts into that.

The expansion will occur through expansion to more tokens, more vaults, more protocols, more blockchains, integration with more investment services, and constant increases in the security of protocols in our system.

Ease will bring about a future in which DeFi isn’t just as safe as, but safer than traditional finance. Ease will bring about a future in which it’s irresponsible for anyone to invest in DeFi without Ease.