Armor is proud to announce Reciprocally-Covered Assets

RCA’s are a peer-to-peer coverage model designed for DeFi assets.

The new model innovates on the current industry standard by using the assets being covered as the underwriting funds. This allows users to cover each other. All the details about this solution can be found in the whitepaper.

Current DeFi coverage solutions

The decentralized finance industry is uniquely prone to financial losses through hacks, scams,

and errors. Historically, it has responded to these threats by creating coverage protocols modelled after traditional insurance institutions to reimburse users in the case of lost assets. Under this method:

- underwriters provide funding;

- risk is assessed;

- a premium price is set for the coverage;

- users purchase a coverage policy.

So far, this has been unsuccessful due to multiple shortcomings:

- the amount able to be covered depends on the underwriters’ supply of capital, which will likely never allow for the full industry to be covered;

- leverage is required for underwriters to be adequately compensated, which introduces a risk of insolvency;

- underwriters must be given a profit incentive to provide capital (and therefore increase costs for users);

- premium prices are exceedingly difficult to set given the data available and the speed with which the industry is evolving.

Introducing Reciprocally-Covered Assets

The model in our whitepaper proposes a new solution. RCAs act similarly to reciprocal inter-insurance exchanges in which users essentially cover each other against risk and use assessable policies with no premiums paid upfront and no capital in reserve.

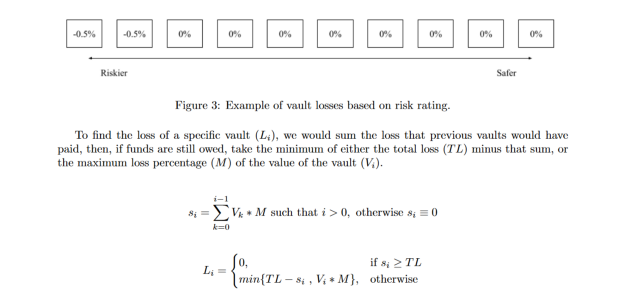

Payments are only made when loss occurs in one of the vaults of the ecosystem, at which point a small percentage of every vault is liquidated to compensate for the affected vault.

This simplifies coverage to its most efficient form. It streamlines the user experience of financial coverage, removes the need for precise pricing in order to maintain solvency, ensures supply grows with demand, and guarantees coverage costs exactly what it needs to cost.

A DeFi-native solution

This method is only achievable in DeFi because it is exceedingly difficult for traditional finance to charge users retroactively in inconsistent and small amounts. With it, we create a system that always charges exactly what needs to be charged, never has coverage supply problems, never miscalculates pricing, and is extremely resilient when the worst case scenarios occur.

RCAs are the first coverage method that is truly unique to DeFi, and the only coverage method with the ability to cover the total value in the sector.

The Armor RCA white paper

The whitepaper, authored by Armor’s Robert Forster, describes the following aspects of the new system in detail:

- The user experience: onboarding and getting cover;

- Costs: when are payments made if not upfront?

- Cost data: based on past hacks and current systems, what would the cost be?

- Incorporating risk: how to diversify between ‘safe’ and ‘risky’ protocols;

- Protocol profit: how can Armor profit from such a system?

Besides this, the whitepaper also dives into:

- Stacked risk: how to cover nested DeFi protocols and their risks;

- Coverage supply: how RCAs remove the need for traditional underwriting;

- Claims: how are they paid out and what is the role of the $Armor token holders?

- Solvency: what happens after a hack of large proportions?

The transition from the current DeFi coverage system to RCAs

The final section of the whitepaper explores the practical issues of implementing this new paradigm, the role of the current Armor Shield Vaults, and how to ensure the security of the system. We plan to transition our current products to make use of this new model. As we look at the road ahead, we answer:

- How can RCA’s cover all of DeFi?

- How will Armor transition into using RCAs?

- RCA’s in a multichain world: a perfect match.

The ideal vision of the RCA system is for users to be able to purchase any RCA directly from an exchange or protocol without ever interacting with the underlying token. This is a vision in which users are perpetually covered against the risks of DeFi without a second thought.

Conclusion

The popularization of DeFi has brought about enormous risk of stolen and lost capital. Current

coverage providers give protection against these risks but have shortcomings such as usability, over- or under-priced premiums, supply constraints, perverse incentives for claims assessors, and potential for insolvency.

The reciprocally-covered asset model provides a simple solution to all of these problems: it always charges the exact amount necessary (from past data, much less than charged by other providers), the supply is directly tied to demand, its claims assessors are not the party that is at risk of losing funds, and there’s much less risk of insolvency than other systems.

It’s a completely DeFi-native model that makes covering your assets simple, cheap, safe, and accessible. Read the full RCA whitepaper here.