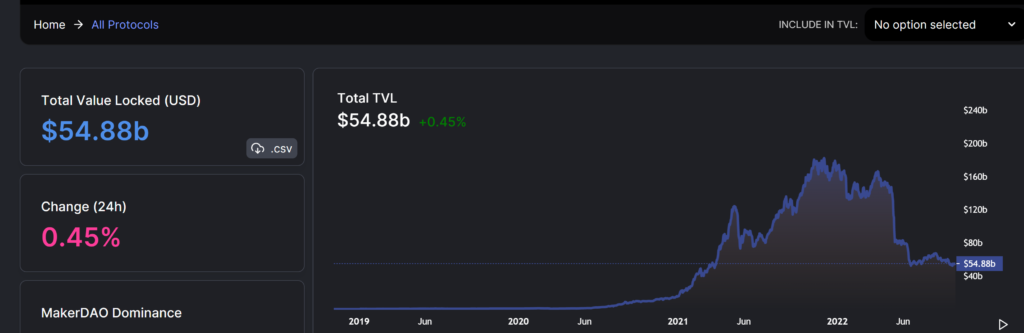

TVL means Total Value Locked. Mostly this locking means depositing in lending, staking and liquidity protocols.

It is an often used metric to determine the (relative) success of crypto protocols and chains, especially in the DeFi sector. But its fame is not entirely justified and easily overrated. Let’s dive deeper into an extended definition of this DeFi TVL:

The TVL is the Total of the current Values of the coins that are Locked in those DeFi protocols.

This definition already shows why it is hard to properly compare and therefore rank TVLs as is done on popular sites such as DeFillama.

-

- Total of current Value of the coins: This is calculated in the $USD value, not in the # of coins deposited.

So, as the value of the underlying coins (i.e. ETH, wBTC etc) changes, the TVL of the protocol changes as well, even though there is no change in the number of coins deposited. Arguably, the actual value locked can be the value at the time of that locking. - Locked: What is locked? There is a huge difference between protocols. Some of the tokens (like CRV) are being locked for up to 4 years, others (CVX) 4 months and Ease only has a 7-day lockup of their tokens. Some protocols don’t have a lock-up time at all, for example, Uniswap Liquidity providers.

- In those protocols: So, if someone deposits 1 million worth of USDC and ETH on Uniswap, then the value is 1m in Uniswap. But where should the locked value be attributed if the LP tokens (the receipt) are deposited in the Ease protocol for free coverage?

Ease then deposits those tokens into Convex or Yearn so they can generate yield while being covered against hacks. So in this case (there are even more difficult multi-protocol options out there) should the Total Value Locked be attributed to Uniswap, Ease DeFi or Convex? Or to all three?

- Total of current Value of the coins: This is calculated in the $USD value, not in the # of coins deposited.

Market Cap vs TVL

The Market Cap is a silly metric as it is the amount of all existing tokens times the current price that 1 buyer will pay for 1 token. After this sale, the price and thus market cap will have changed already. What is there to stop a protocol from minting a billion tokens and then “selling” 1 of these for $1? This creates a Market Cap of 1 Billion!

TVL is just as volatile, especially if these homemade native tokens are at play.

What if we would pool a freshly minted token that has a fake price with an existing token with a widely accepted price? We can fake TVL. And to illustrate this point, that’s exactly what we did!

« Back to Glossary Index