Fear and Loathing in the Bahamas

The current bear market saw a lot of spectacular events sodden with negativity, drama and shock. But crypto remembers 2022 for the tragedy to dwarf them all. The collapse of the FTX house of cards.

One of the most prominent crypto exchanges, a major market-maker, centre of social confidence and the face of crypto in front of Legacy World representatives, revealed itself to be a pit of depravity, corruption and unbridled fraud under its fancy lid.

This event is already changing the rules of the game and DeFi needs to take a stance.

Crypto as a scapegoat

The facts surrounding the scandal are shocking and revolting. New information makes it clear this isn’t a mere incident, it’s a true conspiracy. Most mass media and regulators take advantage of people’s emotions to smear crypto as a whole. However, a closer look reveals the problem doesn’t lie with crypto. It’s conveniently being used as a scapegoat in yet another financial disaster caused by a mix of greed and incompetence…

The facts surrounding the scandal are shocking and revolting. New information makes it clear this isn’t a mere incident, it’s a true conspiracy. Most mass media and regulators take advantage of people’s emotions to smear crypto as a whole. However, a closer look reveals the problem doesn’t lie with crypto. It’s conveniently being used as a scapegoat in yet another financial disaster caused by a mix of greed and incompetence…

As the court goes through Sam Bankman-Fried’s (SBF) entire life, starting from MIT, his parents’ connections with Stanford and Silicon Valley also become apparent. We’ve seen SBF displayed by the media as friends with many government officials. These openly declared their generous support for FTX.

Senator Elizabeth Warren and the SEC’s Chairman Gary Gensler are both marked enemies of the crypto industry. Aside from the outrageous bipartisan lobbying, it turns out they have been involved with SBF on more personal grounds and not merely on what donations can buy.

With a little help from their friends

As the focus also shifts from SBF to the Alameda CEO, it becomes more and more obvious that the group of youngsters who ran the FTX-Alameda grand theft were too “unsophisticated and inexperienced” to pull all this by themselves. Psychologist Nadja Bester observes that the perpetrators hail from well-educated and well-to-do families.

As the focus also shifts from SBF to the Alameda CEO, it becomes more and more obvious that the group of youngsters who ran the FTX-Alameda grand theft were too “unsophisticated and inexperienced” to pull all this by themselves. Psychologist Nadja Bester observes that the perpetrators hail from well-educated and well-to-do families.

She explains that money itself doesn’t seem to be the driving force behind the fiasco, but a more pathological psychological condition. This character profile is rooted not in the fundamentals of crypto itself, but in hunger for power, gambling and dubious belief systems, as also picked up by Forbes.

News abound with titles underscoring the close ties of the big banks and the US Democrat and Republican Parties with the whole jobbery, as the money-laundering suspicions seem endless.

It’s still a mystery how so many institutions, investor groups, politicians, business people and regulators missed seeing how hollow an entity FTX was. This is despite all the investment interest and the high level the game was played at. Even SEC’s Chairman Gary Gensler had the perfect opportunity to gain a lot of information about FTX due to his frequent communication with SBF. Instead, however, he chose to look in a completely different direction, his weird behaviour drawing the attention of US representatives.

Power Corrupts, not crypto

Regulations have never worked in TradFi

High-position individuals and institutions immediately raised their voices: it’s high time for the Legacy TradFi world to start regulating the whole crypto space like it’s part of the fiat financial system. This blatant hypocrisy comes to obfuscate the fact that the Legacy system is failing. The FTX case is merely the latest in a series of legal failures of centralized finance. One can easily draw parallels with the infamous Wirecard scandal, but in reality, the historical examples are numerous.

High-position individuals and institutions immediately raised their voices: it’s high time for the Legacy TradFi world to start regulating the whole crypto space like it’s part of the fiat financial system. This blatant hypocrisy comes to obfuscate the fact that the Legacy system is failing. The FTX case is merely the latest in a series of legal failures of centralized finance. One can easily draw parallels with the infamous Wirecard scandal, but in reality, the historical examples are numerous.

The fundamental principles of these shenanigans do not lie in the intrinsic specificities of the crypto space. Cryptocurrencies just happen to be the biggest opportunity of our time and as with any store of value, corrupt individuals in positions of centralised power will try to exploit it and its users.

Deutsche Bank didn’t need crypto to help destroy the US mortgage market, launder money in Russia, manipulate Interest rates or violate embargoes. None of the regulations in place stopped that behaviour and it wouldn’t have stopped FTX. They were just another Tradfi institution where greed and politics took precedence over clients and users, with or without crypto.

Just like Madoff and Ponzi did before them, FTX scammed users simply trying to improve their financial situation.

At the end of the day, crypto itself didn’t contribute to this fraud scheme. One just needs regulators to be friends with your parents and with enough millions for political lobbying and buying the support of social influencers and big media. One could commit the same fraud with regular stock exchanges or any other sufficiently centralized financial sector.

Deadly Regulation

Given the blemished history of centralized finance, the whole idea that SBF could come up with the Digital Commodities Consumer Protection Act (DCCPA) himself seems more and more unlikely.

Given the blemished history of centralized finance, the whole idea that SBF could come up with the Digital Commodities Consumer Protection Act (DCCPA) himself seems more and more unlikely.

Coindesk called it “a de-facto ban of Decentralized Finance […] that would effectively kill DeFi in the US”. The Blockchain Association called for revisions, stating that “the bill is either too narrow or unclear and would unintentionally harm the crypto ecosystem”.

Of course, it all looked like an unintentional tragedy weeks ago. However, SBF turned out to be a pathological fraudster. He audaciously stole billions of user assets and the light on the facts quickly changed.

One of the most vocal and arguably the most toxic anti-crypto US politicians so far has been Senator Elizabeth Warren. The father of SBF, Joseph Bankman, helped Senator Warren draft her Tax Simplification Bill in 2016. Joseph himself is a Professor of Law at Stanford University.

Initially, when all of this seemed unintentionally harmful, the broader crypto community accused SBF that the regulatory framework he was lobbying millions for was all in the interest of FTX itself, which was a Centralized Exchange (CEX).

After the house of cards crumbled, it’s now evident the DCCPA actually satisfies all persons and parties SBF is affiliated with. Most importantly – it satisfies the regulators who turned a blind eye to his crimes.

Deadly Delusions

The widespread notion that ‘more regulation for crypto will lead to more adoption’ is familiar to veterans and newbies alike. It’s time to seriously put this under scrutiny.

Mass adoption of crypto has always been viewed in the context of return on investments that produce millionaires. But everything has a price and it’s easy to misinterpret financial freedom as just having money. If regulations lead to mass adoption, which creates many new millionaires but at the cost of financial freedom, then crypto would fail in its mission.

Cryptocurrencies without financial freedom are just CBDCs.

Ultimately, regulations won’t make it easier for the average person to adopt crypto. Instead, it opens the way for institutional money to enter the space and turn it into a Stock Market 2.0. Huge financial players in centralized Legacy TradFi don’t like the idea of entering markets they do not control. It’s the oldest financial wisdom: To accumulate and keep generational wealth, you need to hold the means to rig the game in your favour.

A dictatorial political regime will never call for more common liberties. It’s the same with big institutional investors – big money will always call for more regulations because they’re on top of that. However, they will never call for more financial freedom, as financially free environments breed competitors.

Famous businessman and entrepreneur Kevin O’Leary is one of the vocal proponents of crypto regulation. He’s also been the paid spokesperson for FTX. After FTX’s demise and despite all the facts that came to light, O’Leary said he would invest in SBF again. He also explained FTX was “robustly built” and allowed him to get “information on a compliant basis”. Despite the now-known fact that FTX had rigged the game for Alameda. They excluded it from its auto-liquidation protocol. They also installed special software to help cover the tracks of user assets being syphoned away.

Does this mean that if SBF somehow doesn’t go to jail, he will again be able to find big capital to back his next endeavour, given there’s enough “regulation”?

Staying True

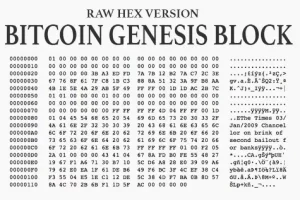

Government regulations are a non-existent concept in the Bitcoin Whitepaper. The original cryptocurrency is a self-regulated financial tool, and so should DeFi be.

The first (“Genesis”) Bitcoin block contained a cryptic message: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”. It referred to the headline for an article in the January 3, 2009 edition of The [London] Times about the British government’s failure to stimulate the economy following the 2007–08 financial crisis.

Nakamoto hated the idea of too-big-to-fail financial institutions, Bitcoin was born to be different: no bailouts, no middlemen.

Decentralized Finance (DeFi) was to introduce a new financial system. A trustless and impartial service that brings financial freedom to every user, relying on innovation for every emerging problem.

Financial freedom is the only true driver of mass adoption, as people leave the failing fiat system and flee from the hellish oppression of CBDCs. DeFi developers should not abandon innovation for superstitious government regulation.

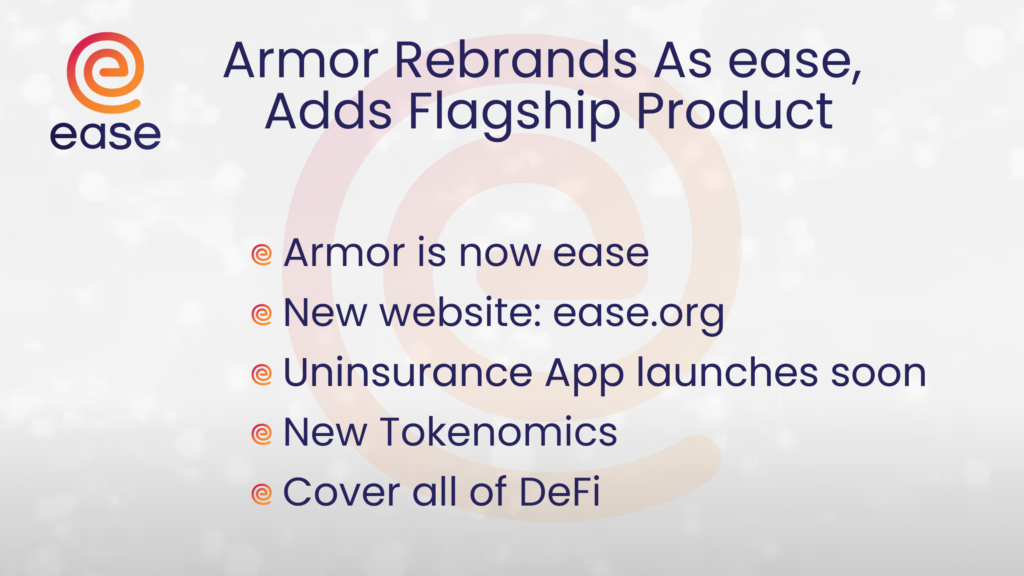

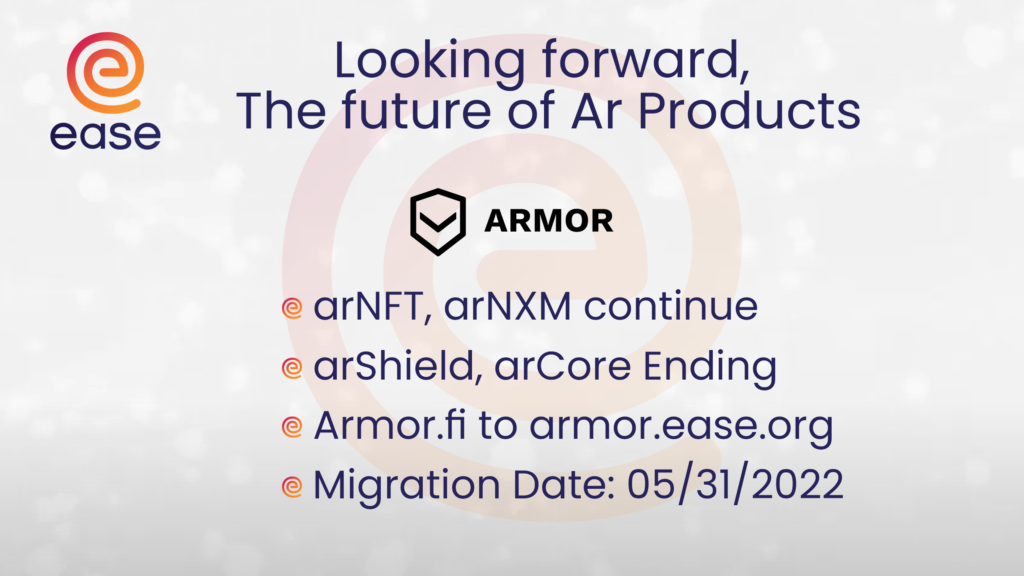

Ease stays true to DeFi’s call. Ease believes in a self-regulated DeFi future through trustless and accessible instruments, tailored to fit DeFi perfectly to continuously ennoble the crypto space.

The TradFi coverage model is constrained by ever-insufficient capacity and inadequate by its inability to price emergent risks. Building a government regulation or self-regulation on centralized fiat coverage principles is a self-defeating endeavour bound to fail. The world doesn’t need more “regulated” financial obscurity, it needs the clarity and immutability of the blockchain.

Decentralised Crypto isn’t the problem. It’s the solution

Ease introduces a fundamentally new approach to DeFi coverage that does away with the limitations of the failing Legacy system. Our Reciprocal Coverage offers the potential to cover every single dollar in DeFi. This is a principle that, if more widely adopted, can be a pillar of DeFi’s future.

The Ease Uninsurance ecosystem directly facilitates DeFi self-regulation. Partly inspired by Curve’s vision, the Ease model allows even DeFi protocols themselves to increase the coverage for their own users. This brings safety and stability to the forefront of community attention. Ease believes in a future where users can buy every yield-bearing token directly at exchanges. These possess inherent premium-free coverage, and Ease made that possible.

The technology is already here. Ez-Tokens are next-level assets in terms of DeFi ecosystem coverage and stability. They are not only yield-bearing but also coverage-bearing and fully tradable. Thus, they transcend the need for alien insurance market regulations and pave the way for a self-regulated DeFi 2.0.

DeFi is the future of finance – a future that’s worth fighting for. Ease devotes itself to innovation and its mission to tame DeFi’s emergent risks. We need you to support our mutual future and innovate, build and grow our self-regulated financial freedom!