The DeFi Insurance Trilemma: a thought piece by ease DeFi Executive Lead Robert Forster (@RobertMCForster).

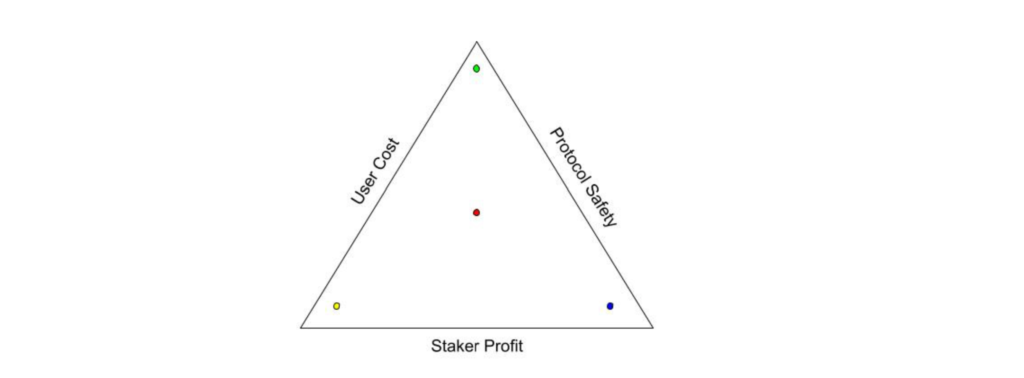

When determining the basic structure of their protocol, traditional DeFi insurance models must find a balance of three main concerns: user cost, staker profit, and protocol safety.

User cost is how much to charge users for coverage of a protocol and is a large factor in the demand you may have. Staker profit is how much money your stakers can make and is a large factor in the capacity of coverage you can sell.

Protocol safety refers to the amount of leverage (and therefore the risk of insolvency) that your protocol takes on in selling more cover than the underwriting capital you have.

To make user costs low, either you take away from staker profits or from protocol safety. To make staker profits high, either you raise user costs or use more leverage and decrease protocol safety. To increase protocol safety, either you raise user costs or lower staker profits.

This brings us to the DeFi insurance trilemma:

- The green dot above has a low user cost and high protocol safety, which may mean no leverage on underwriting capital and users pay a low amount per year, but the protocol will attract no stakers.

- The yellow dot has a low cost and high profit, requiring a large amount of leverage on underwriting capital, resulting in a very unsafe system.

- The blue dot represents high staker profit and high protocol safety, which may mean there is no leverage on underwriting capital and stakers make a lot, but users need to pay a very high amount per year.

Traditional DeFi protocols must aim to be somewhere around the red dot to be viable: a balance between cost, profit, and safety. It’s a delicate rope to walk and I worry that many are/will trend toward the yellow dot.

Protocol safety through higher leverage of underwriting capital is a much more abstract concept, it only affects the protocols once it’s too late, and success is measured based on a protocol’s amount of use.

Because of these facts, it may be very tempting for protocols to pay less attention to mitigating insolvency.

The other worry is that protocol safety is extremely difficult to judge in an industry so new that’s evolving so fast. When you leverage underwriting capital, you’re making the bet that multiple protocols won’t get hacked at once.

I believe this is an extremely risky bet in DeFi. Not only are there risk correlations between protocols security experts don’t see (see: blizz finance/venus protocol when the Luna crash occurred), but new exploits often bring sprees of hacks.

For example, the development of flash loans opened up entire new attack vectors no one anticipated and a spree of hacks occurred. ERC-777 did similar. Even re-entrancy was popularized after the DAO hack and exploited heavily. Who knows what will come next?

@EaseDefi believes that our protocol relying on risk assessment in an industry with such a short history is a recipe for disaster. Our Uninsurance model simply removes the staker profit concern and places us at the green dot of the trilemma.