Ease has been busy this summer

So, what have we been up to during the 2023 Summer? The many global heatwaves notwithstanding, we are still in Crypto Winter.

Crypto winter has been strong this cycle… Though many projects have been frozen because of it, new seeds have been planted and are secretly hatching.

The Ease team has been doing what they do best: build.

In this update, we’ll dive deeper into the newest additions to the Ease product portfolio. They are all focused on one main thing: protecting DeFi users.

1) Ease and Uninsurance updates.

1) Ease and Uninsurance updates.

2) New projects & WhitePaper

3) The Ease Education and our portfolio

Ease updates

First of all:

Ease Uninsurance users have had 18 months of no-premium and no-cost full DeFi coverage.

17 months of our #DeFi native insurance alternative! Zero hacks, zero premiums, zero fees.

All of our users have paid 0% in premiums for full stack coverage of their DeFi assets. 🧘 https://t.co/mQmWRUHep0 #CoverYourAssets #DefiSafely https://t.co/eWNn7xVojS

— Ease.org (@EaseDeFi) September 18, 2023

At any other DeFi coverage protocol, this would have cost at least a few %! And that’s only if these insurers have enough capacity to start with. Remember: Ease Uninsurance doesn’t charge fees, only in the case of a hack the loss is divided between all participants. As the assets to be covered are the collateral, the capacity is unlimited!

Removal of team liquidity.

The Ease Governance token has been described as a Swiss Army knife of tokens. It has many functions and owning some might create many benefits.

The team started a Uniswap V3 pool when the token launched to facilitate trading, but has withdrawn team liquidity from that pool.

- There are a couple of reasons for this:

The pool had locked up a big chunk of team ETH funds needed to hire a new developer (see below). - The token is far undervalued and the team decided that there were better uses for the locked-up tokens, for example, farming (see below) or a new round of investment.

The CoinGecko page might show the token as inactive, but the token itself is still tradeable. There is still liquidity left and all $Ease holders can add a liquidity range to the Uniswap V3 pool, or buy more $Ease here.

Hiring a new Ease Superstar

The team managed to get Tomas on board, and he has superpowers. Backend, frontend, and design are just some of the fields he excels at.

He’s involved in all of Ease’s projects and even during the holiday season, his help has increased our GitHub activity into overdrive!

Presentations, workshops and Twitter spaces

By the way, we also had some interesting public discussions about security, safety and privacy in DeFi. Check out:

By the way, we also had some interesting public discussions about security, safety and privacy in DeFi. Check out:

Ease COO Harry at the #ETHDam security panel, you can watch the entire discussion here on YouTube:

🔐 #ETHDam "Security in DeFi" Panel

with @rkstan, head of BD at @NexusMutual @Evert0x, co-founder of @sherlockdefi

Harry Kikstra, a COO of @EaseDeFi

and Kiril Ivanov, a co-founder and tech lead at @bright_union

moderated by @jpknegtelhttps://t.co/pjLMFoMw4q pic.twitter.com/u6mYcjV6dR

— CryptoCanal (@CryptoCanal) June 7, 2023

Dominik and Emil did a great workshop about DeFi at Web3Berlin (docs here):

We'll be hosting a side event @berlinweb3com! Stop by a learn how to #DeFi safely 🧘 https://t.co/WXtKY3Y2eZ

— Ease.org (@EaseDeFi) June 1, 2023

Ease CEO Robert did a great and informative Twitter Spaces about Inedible. Listen to the recording here:

🚨 You’re not going to want to miss this space! Join us to have an interactive conversation with the dev @RobertMCForster regarding the #INEDIBLE token and launch of #inedibleX.

It’s going to be one for the books that is for sure!

— Rachael (@IrRach40086) July 5, 2023

Last week Robert was invited together with other DeFi dev rockstars to discuss legitimacy in the memecoins sphere and how the Ease portfolio products could make the space safer.

Join us for episode 1 of $ZOOMER Talks with @RHLSTHRM 🚫🧢

Building legitimacy in the memecoin space ‼️

With special guests – @TimTannerVXL_ @youranonweb3 @BlocksNThoughts @RobertMCForster @mousewormerc 👀https://t.co/qUXzV3DCSM

— ZOOMER (🚫,🧢) (@ZoomerCoin) September 12, 2023

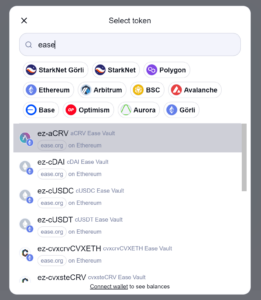

1-step buying of EZ tokens using Wido

We had already pre-announced the plans to make covered DeFi even easier and together with the good people at Wido we have done so!

We already integrated the first 13 Uninsurance vaults and are on the Wido waiting list to add the rest as well. Basically what this means is that soon™ everyone who doesn’t want to go through all the fairly difficult steps of getting free Unininsurance now has an alternative!

We already integrated the first 13 Uninsurance vaults and are on the Wido waiting list to add the rest as well. Basically what this means is that soon™ everyone who doesn’t want to go through all the fairly difficult steps of getting free Unininsurance now has an alternative!

So, instead of buying several tokens, adding liquidity in several different protocol apps and depositing them at Ease to get premium-free DeFi coverage, they can now just do so with a few simple steps:

- Check out the Ease Uninsurance vaults and choose one that offers a good APY

- Swap from USDC or ETH directly into Ez-tokens: fully covered and auto-compounding yield-bearing DeFi tokens.

- That’s it, nothing else is needed! They now own covered yield-bearing tokens and the yield will auto-compound!

Unlike the premium- and fee-less regular Ease Uninsurance deposits, the direct swapping service does have a small cost of 0.3% swapping fee (plus gas costs), so the same as a regular Uniswap swap.

The fee will be divided between Ease and Wido and of course, $Ease holders can use the DAO to vote on how these fees should be used.

Farming is ready to be turned on

We already pre-announced the EZ-farming in Spring, and during summer we have implemented this. The team is running some final tests and then we will push it to the live site. The DAO will need to decide on what the exact rewards will be. This could be $Ease tokens or some other way that active users of Uninsurance will benefit.

Remember that this is not just hit-and-run dumpfarming: active users who have deposited their DeFi tokens for free cover (or those that have bought directly using Wido) have gotten EZ-tokens in return. Those tokens can be staked and farmed.

$Ease tokens rewards are very useful for EZ-token holders, as staking $Ease can lower the max pay-out (in case of a hack) to zero! So, there is little incentive to sell the rewards! Instead, they will be used for staking and governance. So, soon the time will come to earn your bag of $Ease tokens by getting free coverage!

2) New projects!

The team has done some interesting other activities during summer. An idea to make the memecoin craze safer quickly left its niche and turned into a much larger and better undertaking!

The Inedible token

At Ease the team is constantly discussing ways to improve the safety of DeFi users. During the daily team meetings we also often discuss threats, trends and DeFi news. One item that came up regularly on Crypto Twitter was the power of Jared.

“Jared from Subway” is the name of the most active ‘sandwich bot’ on the Ethereum network. Basically, ‘sandwiching’ means that the bot checks the ETH mempool for upcoming token swaps, which are then front-run, which leads to loss for DeFi users.

ELI5: If someone wants to buy (or sell) a token, Jared gets in front of the line, buys (or sells) them first and sells (or buys) them for more. The user pays for the difference and Jared usually earns a bit to a lot but can lose a lot in gas fees as well.

Jared can win or lose, but the DeFi user always loses and often quite a lot if they set a high slippage for their trade.

The token that can’t be sandwiched: $Inedible

The team discussed this, together with the rise of Pepe and other memecoins and came up with a token that covered both issues: $Inedible. The idea was as simple as brilliant: the inedible token can’t be sandwiched as no more than 2 transactions can be made inside one block.

It was brilliant to see how Jared and the other bots tried but failed. It soon caught the attention of a lot of people on CT and organically a huge community started spreading the word!

Incredible Inedible memes, gifs and other excellent artwork were made by the brilliant community. This resulted in millions of trading volume in just a few days!

Of course, with $Inedible we only managed to save the DeFi users from bots for that exact token. The success and popularity of $Inedible made us think again: what if we could actually protect all tokens and all users from sandwich attacks and protect them against rugging memecoins as well while we’re at it?

InedibleX

This is how the idea of InedibleX was born. Instead of protecting users at a token level, we decided to turn it up a big notch: we created a new DEX, a fork of Uniswap, which had the same protection as the Inedible token built in for all tokens.

And we didn’t stop there. Inediblex also functions as a launchpad. New projects can launch their tokens on InedibleX. They will need to lock their liquidity, so they can not rug by removing it all a few days after launch.

In order to launch on InedibleX, projects had to airdrop between 1% & 10% of their token supply. These were divided between all $Inedible token holders!

So, $Inedible turned from an exciting meme-coin without any value to a DAO governance token that could receive a sizeable share of the next Pepe! Meanwhile, the Inedible community was incredibly helpful in polishing the ideas!

While half the planet was suffering from heatwaves and thunderstorms, the Ease team built a complete protected DEX from scratch in just over a month! Check it out here: https://inediblex.com/

Just one more way the Ease team is protecting DeFi users. Follow progress here on Twitter: https://twitter.com/INEDIBLE_Token and join the Telegram Community here: https://t.me/inedible_coin_portal

Inedible TeleGram bot

Ease is a lot more than DeFi coverage. Our mission is to stop scammers and bad actors everywhere. So when last week a valued community member was scammed by a fake admin, we decided we had to do something. Introducing InedibleBot: a Telegram bot to fight scammers.

InedibleBot stores admins from any chat it’s in and compares forwarded messages to that admin information. If the forwarded message comes from someone trying to masquerade as a registered admin, the user will be warned and the impostor will be banned in the admin’s chat.

InedibleBot stores admins from any chat it’s in and compares forwarded messages to that admin information. If the forwarded message comes from someone trying to masquerade as a registered admin, the user will be warned and the impostor will be banned in the admin’s chat. pic.twitter.com/ZamGNQkxdf

— INEDIBLE/inedibleX (@Inedible_Token) July 26, 2023

We started with a beta test on our Inedible telegram but expanded it to allow anyone to use the bot. Instead of “Does not DM first”, admins can now emphasize “Fwd DMs to InedibleBot”. One more way the Ease/Inedible team is making DeFi safer.

InedibleBot is now officially in public beta for any team who wants to use it! Inedible has been using it for a while and it’s been working beautifully.

A new WhitePaper: GOAT Trading

After a few test launches of new projects, we found some limitations and some possibilities that InedibleX offered. So, we took it one step further. We wanted a multi-faceted solution. One that protects users and makes it hard for protocols to rugpull, but easy for honest protocols to start.

Token launches on DEX’s are called Initial Dex Offerings (IDOs). They have become the most common way to launch blockchain tokens, but they come with many problems.

From rug pulls to scams to simply needing starting liquidity, there are many ways IDOs can go wrong.

Ease CEO Robert wrote a new whitepaper to address this. In it, we propose a novel decentralized exchange that evolves from a bonding curve into an automated market maker (AMM) while maintaining an identical user experience.

It combines the best of presales and direct IDOs by allowing teams to raise presale funds while their token is fully tradeable. Any type of token may be launched on this exchange, and after the presale period, the AMM will be fully compatible with the rest of the decentralized ecosystem.

We then expanded on the features of this exchange and its benefits to users. Expect this very soon…

The Ease Education and our portfolio

There’s so much to do in DeFi and space to grow, innovate and build! Our team started with the idea to make DeFi coverage better, building on top of existing coverage protocols, but quickly evolved into a new, first-mover coverage provider. Our side-project started as an amusing but useful proof-of-concept token, but then quickly evolved into a whole new DEX concept.

Ease has a mission to make DeFi safer. For years we were focused on coverage itself, but DeFi has a vast unrealized potential and it’s hungry for innovations. Naturally, the Ease mission stayed the same, but our field of operations has expanded well beyond coverage.

In the immediate future, we’re also starting the release of our Ease Educational Series. The goal of this endeavour is to facilitate the emergence of a specific DeFi culture, that helps all DeFi users adopt a safer behaviour in everything they do in crypto.

In the immediate future, we’re also starting the release of our Ease Educational Series. The goal of this endeavour is to facilitate the emergence of a specific DeFi culture, that helps all DeFi users adopt a safer behaviour in everything they do in crypto.

The release of these educational materials will unify the Ease portfolio and will underscore the ways by which Ease makes the whole of DeFi safer. Next week we’ll release Pt1:

Conclusion.

So, even though Crypto Winter has frozen a lot of assets, the Ease team has been busier than ever. The team is building more parts of the Ease DeFi portfolio and tying everything together. We are currently discussing various ways how the $Ease and $Inedible users can benefit from all of the above. One thing is certain: we’ll be ready for Crypto Spring and trust you will be right there with us.