Frequently Asked Questions

Today we wanted to share some of your frequently asked questions about arNXM. What it is, how does the newly updated vault work, how does it relate to other products in the Armor ecosystem and its benefits.

If you’re new to arNXM, check out our arNXM Success Guide Part 1 to get started.

Feel free to reach out to an Armor Knight on Discord if you have a question that isn’t answered here:

What is arNXM?

The arNXM Vault allows users to deposit wNXM or NXM tokens in the Nexus Mutual ecosystem and earn yield without needing to be a Nexus Mutual member.

Users depositing (w)NXM receive a new arNXM token, which is a tradeable yield-bearing token for the vault, and which is not subject to the mandatory 30-day lockup period.

The vault will hold a set amount in the reserve to provide liquidity for exchanges between arNXM and wNXM tokens and stake the remaining holdings into the Nexus Mutual system to generate yield by unwrapping and staking the wNXM tokens in the Nexus Mutual ecosystem, thereby opening up cover capacity, which can be bought by users.

Please see all technical details of the arNXM vault here in the Armor Documentation.

What Is the relationship between arNXM and wNXM?

Due to the returns on the Nexus staking, as explained here in the Gitbook, the value of arNXM will rise relative to the value of wNXM. This price difference should grow consistently, but in case of a payout due to approved claims, that difference might temporarily lower again.

This will be replenished by the Treasury Reserve paying off the debt so the long term trajectory should only go up. The current conversion rate and APY can always be found on the vault page.

Those who stake into Nexus through the arNXM yield vault enjoy a second layer of protection, thanks to an industry-first and exclusive coverage for liquidity providers.

The Armor treasury reserve takes on all losses incurred as debt and repays losses over time to fully replenish the arNXM ratio back to where it was before the loss. Given that revenues are stable and capable of paying back the loss, staking into the arNXM yield vault is essentially zero risk with considerable upsides. Note that staking directly through Nexus provides no such coverage.

What are the arNXM yields and benefits?

The arNXM yield vault generates yields ~15% on the underlying NXM. If staked into one of several liquidity pools on armor.fi (see question #7 below), users can also gain an additional 15–30% yield on top, giving them a total of ~30–45% net yield.

Both parts aren’t fixed and dependent on various aspects (Armor token price, Nexus staking yield, hack payouts, how many others stake in the pools etc), so can and will fluctuate both ways, but this is all in addition to maintaining exposure to NXM price appreciation.

What is the current USD price of arNXM?

You can view arNXM price and trading volume here: https://www.coingecko.com/en/coins/armor-nxm

Using the Vault: How do I swap wNXM for arNXM?

If you have NXM of wNXM in your wallet, go to the vault page and connect your wallet: https://armor.fi/arnxm-vault

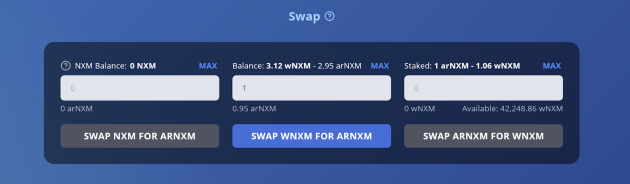

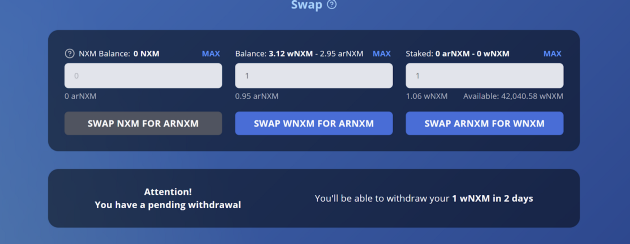

There are 3 boxes in the top section:

- The first one is to swap NXM for arNXM

- The 2nd box is to swap wNXM for arNXM

- The 3rd box is to swap the arNXM back to wNXM

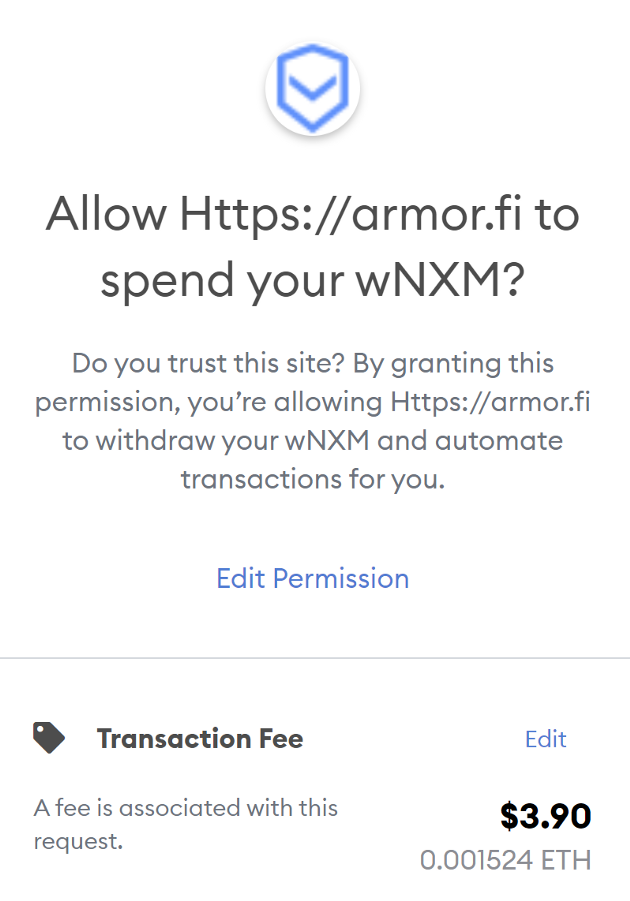

You can enter how many wNXM tokens you want to deposit and the deposit box will show you the arNXM rate. Once you click the blue swap button, an Ethereum Transaction will appear as the Armor site needs approval to use your wNXM tokens:

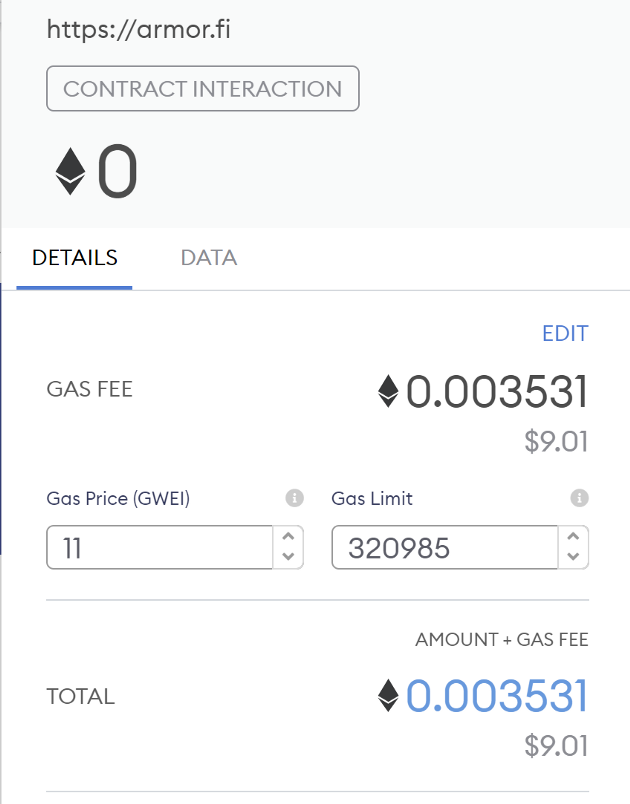

After this approval is confirmed, a second transaction will start, for the actual deposit:

That’s it! Now your deposited tokens will earn a share of the yield that is created by staking them for you.

As NXM isn’t freely tradeable outside the Nexus Mutual platform, most users will deposit the wrapped version of the token, wNXM. As this token can be traded, you can also trade it for arNXM on the main DEXs, which are linked just below the boxes:

Using the vault: how to withdraw wNXM: fee vs time delay.

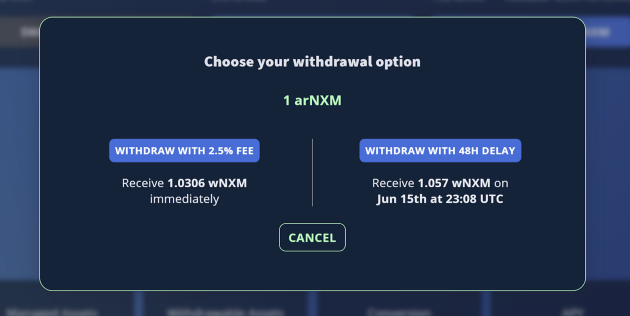

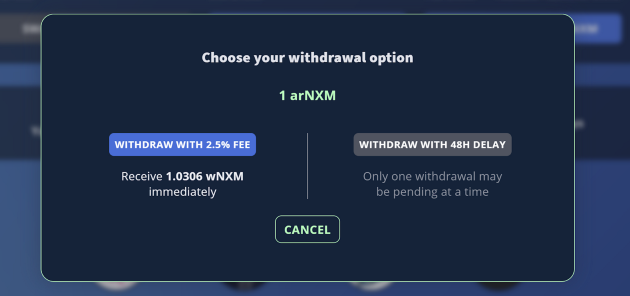

Remember — the third box is to withdraw wNXM by swapping the arNXM token. Once you decide how many you want to swap, clicking the blue button will show you the following pop-up:

As you can see, there are 2 withdrawal options. You need to choose one of them or cancel. The options:

- You can withdraw against a 2.5% fee, in which case you will get your wNXM tokens immediately, or

- You can do a time-delayed withdrawal. This way, you will receive the full amount, but you need to wait 2 days before you can actually do the withdrawal.

In both cases, you will see the amount you will receive and the date/time when you will receive it.

Note: To read about why the fee and the time delay have been implemented, please read arNXM Success Guide Part 1.

If you choose the fee option, you will see the wNXM tokens in your wallet the moment the Ethereum transaction has succeeded. If you chose the time-delay option, a new box will appear after the Ethereum Transaction is done:

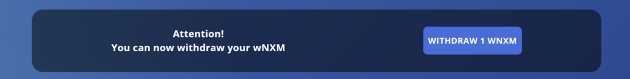

At this time, you will be shown your pending withdrawal. The amount and a timer showing the remaining time until the withdrawal can be finalized. Once the timer reaches zero, a new [WITHDRAW] button appears. This will create a final transaction to actually receive the wNXM tokens.

Can I start another withdrawal while I have a pending one?

Once you have a pending (time-delayed) withdrawal you can still start another withdrawal. You can only choose the immediate withdrawal with 2.5% fee option though, as you cannot have 2 time-delayed withdrawals simultaneously:

How can I stake arNXM LP tokens to earn $ARMOR?

Once you have $arNXM, you may pool them with ETH tokens on any of the supported DEXs. Then you can stake them to earn ARMOR rewards.

To stake, simply go to the rewards page and click the “Stake Tokens” button. Two MetaMask transactions will pop-up: one to approve the transfer and then one to stake. You must confirm both.

Once your tokens are staked, you will begin to earn ARMOR rewards.

To receive your ARMOR rewards, click “Claim Rewards”. You may also unstake your tokens at any time.

What is the relationship between arNXM, arNFT and arCore?

Understanding the relationship between arNXM and arCore helps illustrate the inherent composability between Armor’s products.

The arNXM vault gives users an easy way to stake into Nexus Mutual. By staking into the Vault, coverage capacity on Nexus Mutual is boosted.

The Armor arNFT is basically a permissionless wrapper for Nexus Mutual coverage. So, boosting Nexus Mutual coverage helps increase arNFT capacity, i.e. more users can buy cover.

The arNFTs in turn can be staked to provide capacity for the arCore Smart Cover system.

Read more about the differences between the arNFT and the arCore cover here.

10. Have a question that’s not answered here?

Read our arNXM Success Guide Part 1, and connect with our Armor Knights on Discord.