The Shield vaults are live and also part of the new Armor referral program

Today Armor is proud to announce our latest product launch: Shield Vaults are live!

With Shield Vaults, Armor users can wrap underlying tokens to receive coverage-bearing tokens, which automatically provide coverage without ever needing any maintenance or renewals. It’s also cheaper than other cover options!

Together with the Shield Vaults, Armor also announces the revolutionary DeFi cover Referral Program, which will be discussed briefly below.

Launching with 5 Yearn Yield Vault Shields

Armor Shield Vaults utilize pooled coverage per protocol (for example Yearn Vaults, Curve Vaults, etc.) across a variety of products for those protocols (for example the Yearn DAI, 1Inch, and YFI vaults). This lowers the percentage of coverage that investors need to pay while maintaining the benefits of full coverage for the first 50% of the Vault’s value.

The first 5 Shield Vaults are live, all of them based on Yearn vaults: DAI (the newly migrated yVault), SNX, sUSD, YFI & 1Inch. The previous beta launch limits (the equivalent of $50k USD per Armor Shield Vault) have been removed. These first 5 Shield Vaults are now fully open.

Yearn is upgrading several of their vaults, once they are finished we will add them as well. We are also working together with a new partner and will be able to easily add dozens of new vaults at once next month.

If you go to the Shield Vault page, you can read some more details when clicking on the [Show more information] button; the following will appear:

Important info

Armored Shield Vaults are covered storage vaults for DeFi tokens with auto-payments, powered by arCore. Users can deposit their DeFi tokens, receive their arToken, and enjoy their FDIC-like pooled coverage in perpetuity with no maintenance needed (please read more about our coverage here before depositing).

Click “Deposit” to add your tokens to a shielded vault. This will create arTokens, representing a covered version of your tokens.

Click “Withdraw” to exchange the arTokens back to the underlying tokens. Both deposits as well as withdrawals incur a 0.2% cost.

Please see the Armor GitBook for more details and examples.

DAI → Yearn Vault DAI → Armor Shield-covered Yearn Vault DAI

When you deposit DAI, SNX etc in the Yearn vaults for yield, you will actually receive special Yearn tokens in return. These typically have the same name as the tokens that were deposited, preceded by “yv” (short for “Yearn Vaults”).

Many users are not aware of these as they will not show up in most wallets unless you manually add them, but they are there! These tokens increase in value the yield that Yearn generates.

They are recognised by the Yearn vaults themselves and by the Armor Shield Vaults as well, (even if you have not added them as a custom token in your wallet).

These yvXXX tokens can now be deposited in their respective Shield Vaults. Currently we have Shields for yvDAI, yvSNX, yvsUSD, yvYFI & yv1inch, later we will add more. When you deposit them, you will get special Armor Shield tokens in return. These are named the same as the Yearn Vault tokens, but with “ar” added to them.

So the Dai you deposited in a Yearn Vault has become yvDAI. When depositing these yvDAI into the Armor Shield Vault, you receive arYVDAI. Again, these tokens will only show up in your wallet if you manually add them. They are there, though and will be recognised by the Shield Vault page.

Auto-Protect Your Deposits

When depositing your yvXXX tokens, a small fee will be used to pay for 1 week of arCore cover. The rest of the cover will be paid by periodically selling small amounts of tokens from the Shield Vault. Just enough will be sold to automatically pay for the cover, which is cheaper than the arCore Smart Cover system and even cheaper than the arNFT cover!

With auto-protection, no additional cover policies need to be taken out. No ETH deposits to pay for cover have to be made, and the tokens can be withdrawn at any moment. The underlying yvXXX tokens will still generate yield, and (part of) this yield will be used to automagically protect your investments.

How to Use Armor Shield Vaults:

In just a few steps you can protect your investments:

Step 1: Go to https://armor.fi/shields and connect your wallet.

If you have deposited some funds in one or more of the aforementioned Yearn vaults, you will see them here.

In this case the user already has 14.96 arYV tokens that were created when they deposited yvTokens earlier. They still have nearly 85 yvTokens that can be deposited.

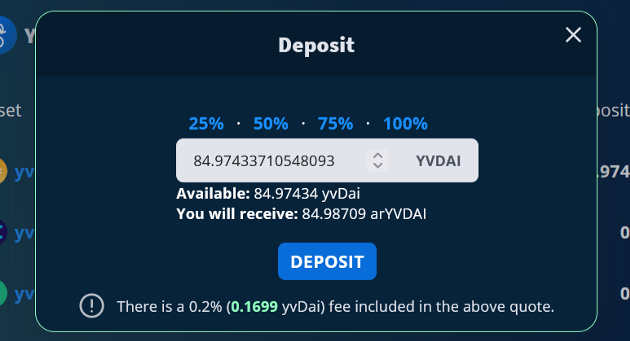

Step 2: Click [Deposit] and choose the amount of your yvTokens you want to protect. You can manually enter the amount or choose one of the listed percentages. Most will simply click ‘100%’.

It will show you the amount of yvTokens that will be deposited/protected and the amount of arYVTokens that you will receive in return, as well as the fee that will be charged on deposit or withdrawal. This is currently 0.2%, half of that fee is reserved for the referral program

Click the [Deposit] button once more to confirm and a transaction will appear (you might need to sign into your wallet first). You need to confirm this with your wallet.

Step 3: There is no step 3! Once the transaction is confirmed, your assets are automatically covered, and will remain so until the moment you withdraw them from the vault (using the [Withdraw] button, which reverses the process above).

Future Shields

We will be adding many more shields. More Yearn-based shields and shields based on other protocols will be released soon, and at a steady rate. Our goal is to protect as much of the DeFi ecosystem as possible with our coverage-bearing tokens.

For more details about how the Armor Shield Vaults work and some examples, please refer to the Armor Gitbook.

Try Armor Shield Vaults here >> https://armor.fi/arshield

Why Armor Shield Vaults?

Armor’s focus has always been to increase the adoption of DeFi coverage and security with great UX and low cost cover. When creating arCore, we realized we could take the 1-click coverage concept one step further. We could eliminate the need for any interaction at all with a coverage-provider, therefore creating 0-click coverage.

Furthermore, it is anticipated that (the first) 50% cover would cover most hacks, given they do not drain a larger amount of TVL compared to total cover sold. (source)

So, even if a protocol Shield has a 50% collateral ratio, as long as the claimed amounts are less than or equal to the total cover available, all claims will be 100% paid. Please refer to the Armor Gitbook for details.

We believe Armor Shield Vaults built-in coverage tokens are the future of DeFi cover, and we’re here to make DeFi safer.

The Armor Referral program

Together with the Shield Vaults Armor is also launching another part of the ecosystem, a revolutionary DeFi referral program!

The Armor Referral program (https://armor.fi/referrals) offers Armor users and other #ArmorKnights an additional income stream by sharing a part of the revenue that is generated by other users they refer to the ecosystem.

The system is already functional and active and currently rewards referrals to the arCore Smart Cover System and the new Shield Vaults, as well as those to the arNXM Vault. Half (0.1%) of the 0.2% fees are reserved for the referral program. This means that every time someone you referred deposits $1m in the Shield Vault, you will earn $1000!

Read the special announcement post and further details about the Referral program here.