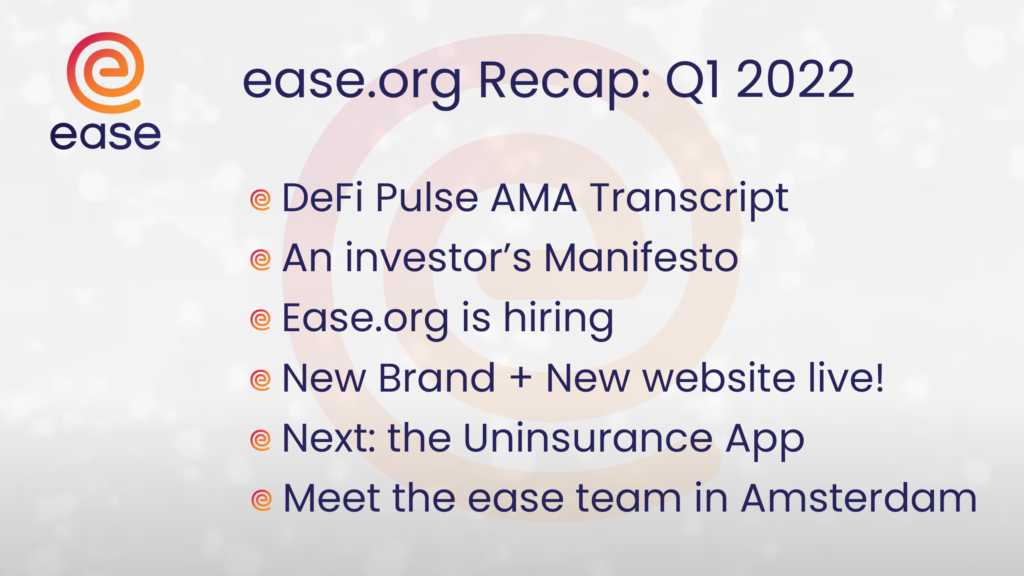

The DeFi Pulse AMA

Last Friday DeFi Pulse Hosted an AMA with a majority of the team behind ArmorFi! There is plenty of exciting information for new investors and seasoned #ArmorKnights.

For those of you who missed it, the full transcript is below.

Highlights include–

- Robert Forster talking about RCAs, Armor’s revolutionary new coverage model (expected release end of February/beginning of March

- Explanation of new utility case for the $Armor token

- Gas refund system for DAO participants to promote inclusivity

- Grant Program launch

Please see below for full details 🙂

Transcript:

(Questions of DeFiPulse host Aishwary and community members in Italic)

Aishwary –

Hello @everyone and welcome! Today we’re excited to have the core team of Armor.fi, We have

- Robert Forster, Co-Founder

- Christopher Hearey, Community Lead

- Romke Jonker, Development Lead

- Harry Kikstra, Operations Lead

Aishwary –

Talking about the team, can you tell us a bit about how it all started and what was the vision or incident that made you start this project?

Robert Forster –

Absolutely! So the product was started around September 2020. There wasn’t a specific incident but we’d seen a huge uptake in DeFi hacks throughout the year, and had noticed the current UX for coverage was lacking when it came to useability.

A flat $20k coverage plan on most assets is okay in the real world, but in DeFi where you are constantly moving funds and the amounts of funds are constantly changing, a plan where you pay $X of coverage for Y protocol then that isn’t very friendly.

So Armor was really founded with a vision focused on UX. We want to cover all of DeFi, and to do that we believe UX is one of the huge factors.

Every one of our following products, and even our fairly major pivot coming up, is really focused around that.

Aishwary –

That’s totally true I’d say, being almost 2 years down in the DeFi Forests I could relate to it very clearly! So, coming towards the project what are the various risks that Armor is covering and which protocols or dapps has it covered or it plans to cover?

Christopher Hearey –

Currently, we utilize Nexus mutual as our coverage underwriter; however, we provide their coverage in a tokenized, permissionless, manner.

The current risks being covered are smart contract risks on over 100 of DeFi protocols and custodial wallets. We cover all types of DeFi users, from LP providers, to yield farmers. There is most likely a coverage option for you.

In February/March we plan to implement a new form of coverage that is no longer underwritten by NXM, called Reciprocally Covered Assets. These will have the ability to cover more beyond smart contract exploits.

Aishwary –

That’s really awesome! Could you please talk more about Reciprocally Covered Assets? I am really intrigued by it and the community would also love to know more about it!

Christopher –

Of course 🙂 this is Robert’s brainchild, so I’m going to let him cover this one for ya’ll.

Robert –

Hell ya we can. It’s a new kind of DeFi-native coverage model we’ve created that’s never been able to be done with traditional insurance.

It takes the idea of insurance back to its roots of risk-sharing. The core aspect is that all assets being covered are also providing coverage for each other.

Each RCA shield vault accepts one underlying token (such as yDAI) and returns back an RCA (yDAI-RCA).

When a hack occurs, a tiny amount is liquidated from every vault in the system to pay back the affected users.

The benefits of this are that:

- cost is as low as possible (there are no premiums as there are no underwriters that require profit),

- the system is much more resilient (a miscalculation of risk won’t cause the system to go bankrupt),

- and the UX is extremely easy, with users being able to zap into RCA tokens the moment they enter DeFi, then have coverage on their tokens for the exact value of them forever; no updates needed, no balances to refill, no payments to make.

We want to make RCAs the standard in DeFi so every new user will have coverage without even thinking about it.

Christopher –

We have the white paper to read here:

Aishwary –

Thank you for sharing this! Now I know where my weekend is going to be spent!

Something new is always exciting and one of the best things being in the defi space and interacting with the projects is that there are new innovations every day and an innovation that could help deleverage the risks and also at a reduced cost. Am I dreaming or what?

Chris –

Stay tuned, because in about 1.5 months time, it will be your reality ^^

Harry –

Our job is to make your dreams come true, Ser.

Robert –

We’re pretty damn excited. The goal is to completely change the public’s view (and the reality) on dangers in DeFi.

Aishwary –

I think this could become the USP of the project as well! Going to my next question: Which are the chains that Armor.fi has already deployed on?

And where is this new product being deployed first?

Harry –

At the moment we are using Nexus Mutual coverage and therefore are limited to the ETH Main net. The coverage itself covers protocols on all chains though!

Also, we love the multichain possibilities and are actively working on expanding our upcoming products to wherever they make the most sense for our users.

Robert –

With RCAs it’s extremely important that our TVL/TVC (same for us) is as high as possible because safety is heavily affected by diversity, so expanding to more chains and more protocols is a priority.

Aishwary –

That absolutely makes a lot of sense. I believe a lot of deployment and heavy lifting needs to be done and that is why the team is aggressively expanding.

Well, good luck for all the work that the team is putting up. Recently I also saw that the project has plans to move towards a DAO? What vision or what aspects are you seeing for such a move?

In the meantime, @everyone, if you have any questions, please post them on ama-questions as we will soon begin answering them.

Christopher –

So the plan for Armor was to always move towards a DAO, as true decentralization was a value shared by the whole team. The $Armor token is a governance token (though we plan to add CRV influenced utility with RCAs).

We actually successfully launched it in November 2021. With our first proposal being a token burn of 250MM from the treasury. It was a major milestone for the team as we even managed to get over 95% engagement from our vArmor holders!

Speaking of vArmor, we currently have a single staking method implemented for the DAO that allows us to provide our user base rewards with compounding yield by having them stake Armor to receive vArmor, which has its value in relation to Armor increase over time.

Currently, the value is increased through a reward faucet set up by our treasury. But the DAO has the potential to vote in profit sharing as well.

We want all of our user base to be able to have a say in the direction of the protocol. So proposals for profit sharing, allocation of treasury funds for community grants, premium or risk costs adjustments are all on the table for governance.

We want our token holders to feel they have influence to steer the ship 🙂

We understand that with current network congestion this is an expensive ask for our smaller holders.

That’s why we have a refund system in place for gas fees associated with voting and delegating votes for proposals so that we can be as inclusive as possible. It wouldn’t be true decentralization without that

Aishwary –

Wow! That is really thought through and a good thing to do! You could also explore some off-chain voting mechanisms as well for more participation imo!

That would probably help even more but refunding the gas fees also does the charm as can be seen by 95% vote rate.

Lastly, Armor.fi has launched a grant program. Could you talk more about it and who all can avail it?

Christopher –

Yea, so the grant sign up form can be found here! Armor Knights: Pledge to your Order

We wanted to create more emphasis on community building, as any decentralized organization requires a strong community presence behind it.

We use our discord to provide project requests and take project proposals for just about anything! For instance, one community member is helping me put together an educational presentation for our entire product line 🙂

From memes, to dev support, to community blog posts there is a wide range of tasks and projects users can participate in, and it’s all rewarded in $Armor to the contributor!

Aishwary –

Education is one prime aspect and if we are able to educate people the right way then it would help in better adoption.

Really appreciate you guys for thinking about it.

Before we hop on to the community questions, would you want to add anything about your future roadmap or provide us with the social media handles for the people to explore?

Harry –

Armor Twitter : https://twitter.com/easedefi

Armor Telegram : http://t.me/ArmorFi

Armor Discord: https://discord.gg/8HuTB22

Armor Website: https://armor.fi/

Armor Blog: https://ease.org

Ease.org website: https://ease.org/

Armor Forum: https://forum.ease.org/

Those are the current channels 🙂

Aishwary –

Thank you so much for all the links. We hope with so many benefits more and more people would want to join. One of the questions that we would want to take from the community before we close would be:

Will Armor (RCAs specifically) cover NFTs and if so, how is the amount of compensation determined for the NFT.

Context: For example, if some genius has decided to splash out $30mill on a drawing of a monkey wearing a hat, and they get hacked and their monkey is stolen, would the whole RCA network have to compensate them for the $30mill?

Harry –

No, though we all love NFT’s (more alpha right there 😉 ), NFT’s in a personal wallet are never covered.

We don’t do custody cover, personal wallets are impossible to cover as we cannot check which hacks/losses actually happened and which are tax losses or worse.

So, the genius that bought the hat-wearing monkey won’t influence the RCAs 🙂

Aishwary –

haha! We all want to just save the floor price risk of the NFT’s.

Thank you so much team for your valuable time and I hope everyone has been able to get their answers. There are some other questions in the ama-questions in case you want.

Really appreciate the whole team for coming here and solving so many questions for us. 🙂

Christopher –

Thanks for having us, this was a wonderful AMA! There are some other questions we wanted to answer for the community, so stay tuned if you asked one!

Will —

What role will the $Armor token have in relation to RCAs?

Robert –

I don’t think we’ve released this info publicly so this might be alpha, but $ARMOR tokens will be used to determine the relative risk ranking of RCA protocols.

A protocol can stake tokens which becomes an indicator of how much they value security and the amount of funds at their disposal.

The tokens will not be used to underwrite risk but simply used as an indicator. Protocols are then ranked for safety based on the amount staked, and vaults pay differing amounts based on that ranking in the case of a hack.

This encourages protocols to compete with each other to stake the most tokens to bring down the cost of coverage and as a sign that they value user security, which brings a similar landscape to protocols competing as the Curve model (even though they’re not directly veTokens).

Christopher –

Thanks, everyone for stopping by and asking your questions! It’s been a pleasure ^^

Be sure to DeFi Safely, and cover your assets

Robert –

10000 thank you to both DeFi pulse and the community!

Harry –

Bye all, thanks for having us, do drop by on our social channels if you have any other questions for the team!