Where we’ve been and where we’re headed.

The Armor ecosystem launched in January 2021 with the mission to make DeFi safer, and within just 4 months, over 1.5 billion USD worth of DeFi assets across 88 protocols have been covered.

Today we’re taking a deeper look at some of the most popular protocols covered by Armor, and what we’ve learned from the data around staking for Armor’s most popular product, arNFT Tokenized Coverage.

What is arNFT staking?

The first product Armor launched was arNFT Tokenized Coverage, followed a month later by the arCore Smart Cover system. arNFT is a non-fungible token wrapper (ERC-721) for Nexus Mutual coverage, which, when staked, enables arCore pay-as-you-grow coverage.

Besides minting an arNFT for your own protection, you can earn rewards by staking them!

The arNFT staking vault generates yield by supplying the underlying coverage to arCore Smart Cover, where it is pooled and brokered to customers at a premium. Then the premiums are dispersed to arNFT stakers.

How do staking rewards work?

Stakers receive rewards as long as their arNFT is active. For example, if the arNFT has coverage for 1 year, the staker will continue to receive rewards for 1 year. The amount of rewards received over that time is determined by the staker’s share in the arNFT pool for that contract and based on the premium per second for the arNFT.

Users who stake arNFTs earn $ARMOR staking rewards, and yield rewards when their staked arNFTs are being sold through the arCore system. Certain platforms might also offer additional rewards for users to stake arNFTs.

Staking stats

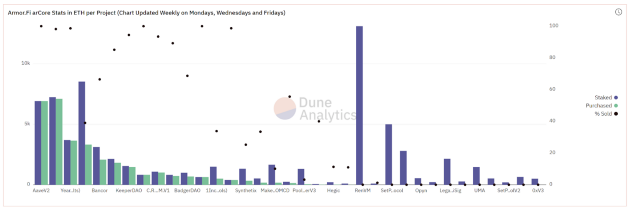

When taking a look at the arCore section of the new Armor Dune Analytics panel, the following can be noticed (these stats are dynamic and will change daily):

- The protocols with the largest amount of staked arNFTs are RenVm, Compound V2 Curve and Aave represented by the blue lines in the chart. Higher lines mean more staked arNFTs and therefore more available cover in arCore for that protocol.

- The protocols with the highest amount of purchased arCore cover are Curve, Aave, Yearn and Compound.

- There are a few other protocols that might not have the absolute amount of cover purchased, but relatively speaking, most available arCore cover is (nearly) sold out for Aave, Uniswap, Alpha Homora and mStable.

Trends

Looking at staking data and protocols covered, one thing we’ve learned in our unique position in the industry is that we’re starting to see more consolidation. Boundaries between DeFi protocols are getting blurred. In general, trends point toward users seeking a blending of services in DeFi: mixing, lending, and swapping. Once a protocol has gained trust from the DeFi users, they will be able to supply many more services than they originally started with.

A couple of popular examples of this:

- Sushiswap now offers borrowing based on collateral, just like Aave.

- Aave has introduced swaps between supplied collateral, basically adding AMM functionality.

Though this trust is an important factor in the ‘stickiness’ of users towards certain protocols, one result of this consolidation trend is that users will also quickly switch to other protocols if their current favourite is hacked, doesn’t offer all-in-one DeFi solutions, or simply doesn’t offer enough apy and ROI. As a result, it’s not too hard to imagine main DeFi protocols CRV and Yearn also expanding horizontally into full-service DeFi powerhouses.

Another trend we’ve seen is that users are moving away from static portfolios to active DeFi ones. This is why the dynamic and flexible “pay as you grow” arCore cover is gaining ground quickly. Users need and want cover that follows their holdings across protocols, and that grows and contracts with the value of them.

Next Steps

In the coming weeks, Armor will implement an update where not all staked NFTs offer the same rewards. Many early stakers were attracted by boosted $ARMOR rewards, where it did not really matter which protocol was staked.

Now though, the focus has shifted to the popular protocols. As seen above, some protocols might not be the most popular in absolute numbers, but relatively speaking, all offered cover through arCore is sold out.

Therefore, instead of rewarding all staked arNFTs the same, the protocols that are closer to the top of the list will receive a larger share of the rewards. This way, the protocols that are in high demand by arCore users will get a larger share of the rewards.

The APY for staking popular arNFTs will then be above 100% again, and staking of less popular protocols will no longer be incentivised, though, of course, the arNFTs are perfectly valid as personal covers.

The redesigned page where one can purchase arNFT cover is now sorted by the percentage of staked arNFTs that are purchased through arCore, showing the most current popular protocols to cover:

$ARMOR rewards will be reallocated to reward the stakers of these protocols that are closest to 100% arCore usage.

What will be the result?

With the upcoming changes to staking rewards, we anticipate that data may change in the following ways:

- More arNFTs will be staked as rewards will be high enough to incentivise this.

- The most popular protocols that are actively used, and therefore need active dynamic cover such as arCore offers, will surface to the top of the list.

- Even smaller protocols that have an active user base will get incentivised and have a chance to grow quickly. Once cover is actively bought, the yearly cost will go down. More arNFTs will be staked, more arCore Smart Cover will be available. And more users will feel confident to use the protocol as they can now use it while being covered against smart contract and protocol risks.

Conclusion

The DeFi landscape is extremely dynamic. New protocols are added every week. Existing protocols expand their offerings in a bid to attract new users and sway others in their direction. By offering different ways to be covered when interacting with the ever-expanding DeFi world, Armor is helping DeFi grow and reach its full potential.