What is TVL?

TVL means Total Value Locked. Mostly this locking means depositing in lending, staking and liquidity protocols.

It is an often used metric to determine the (relative) success of crypto protocols and chains, especially in the DeFi sector. But its fame is not entirely justified and easily overrated. Let’s dive deeper into an extended definition of this DeFi TVL:

The TVL is the Total of the current Values of the coins that are Locked in those DeFi protocols.

This definition already shows why it is hard to properly compare and therefore rank TVLs as is done on popular sites such as DeFillama.

-

- Total of current Value of the coins: This is calculated in the $USD value, not in the # of coins deposited.

So, as the value of the underlying coins (i.e. ETH, wBTC etc) changes, the TVL of the protocol changes as well, even though there is no change in the number of coins deposited. Arguably, the actual value locked can be the value at the time of that locking. - Locked: What is locked? There is a huge difference between protocols. Some of the tokens (like CRV) are being locked for up to 4 years, others (CVX) 4 months and Ease only has a 7-day lockup of their tokens. Some protocols don’t have a lock-up time at all, for example, Uniswap Liquidity providers.

- In those protocols: DeFi protocols are composable, also known as DeFi Legos, but that makes it even harder to determine and attribute TVL.

If someone deposits 1 million worth of USDC and ETH on Uniswap, then the value is 1m in Uniswap. But where should the locked value be attributed to if the LP tokens (the receipt) are deposited in the Ease protocol for free coverage? Ease then deposits those tokens into Convex or Yearn so they can generate yield while being covered against hacks.So in this case (there are even more difficult multi-protocol options out there) should the Total Value Locked be attributed to Uniswap, Ease DeFi or Convex? Or to all three?

- Total of current Value of the coins: This is calculated in the $USD value, not in the # of coins deposited.

Market Cap vs TVL

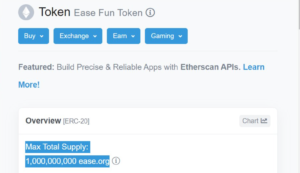

The Market Cap is a silly metric as it is the amount of all existing tokens times the current price that 1 buyer will pay for 1 token. After this sale, the price and thus market cap will have changed already. What is there to stop a protocol from minting a billion tokens and then “selling” 1 of these for $1? This creates a Market Cap of 1 Billion!

TVL is just as volatile, especially if these homemade native tokens are at play.

What if we would pool a freshly minted token that has a fake price with an existing token with a widely accepted price? We can fake TVL. And to illustrate this point, that’s exactly what we did!

How to become trillionaires and get 3 tokens into Uniswaps TVL top 10 TVL!

Enter our new token “EASE.ORG funtoken”

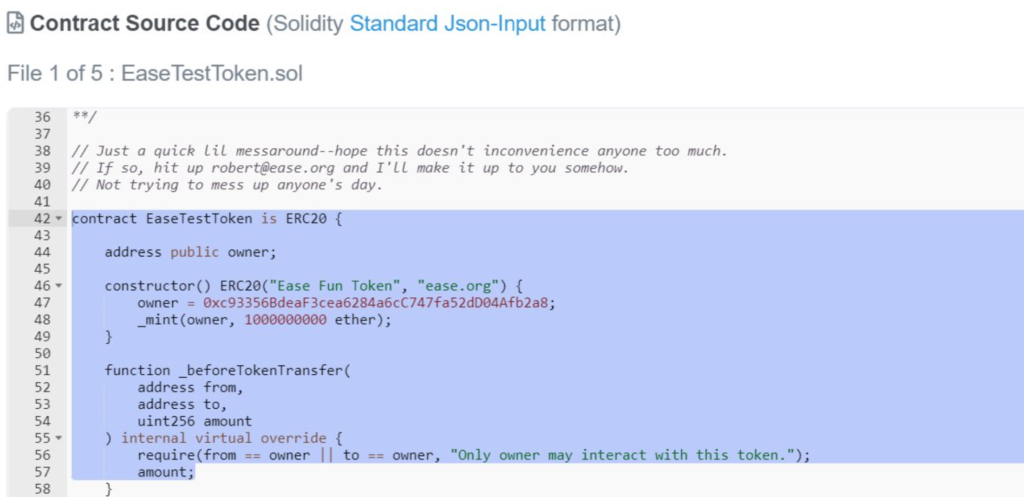

First, we made a token, which anyone can do. We called it EASE.ORG funtoken. This way it was clear this was not a real token and the good people from Uniswap would know how to contact us if needed.

No one was at risk here. Unlike many other fake tokens, we didn’t design our token to scam users out of their funds.

We coded the token to only allow one address to conduct transfers: ours. No one was at risk of accidentally buying this token and losing money.

Getting a fair price for our token

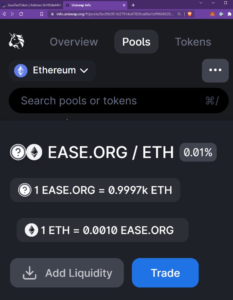

Next, we needed to give this token a price. We created a liquidity pool on Uniswap, combining our token with an existing one with a clear value: Ethereum.

So we paired our ease.org token with Ethereum in a liquidity pool. Uniswap contracts automatically assigned a price to our token. This price is based on the ratio between the two tokens.

When creating a pool, the creator decides the initial conversion rate between the tokens in the pool and therefore its value! We made each ease.org token equivalent to 1 million dollars.

Voila, we are trillionaires!

So according to Uniswap’s price info, we’ve just become trillionaires, since we minted 1 billion ease.org tokens.

So according to Uniswap’s price info, we’ve just become trillionaires, since we minted 1 billion ease.org tokens.

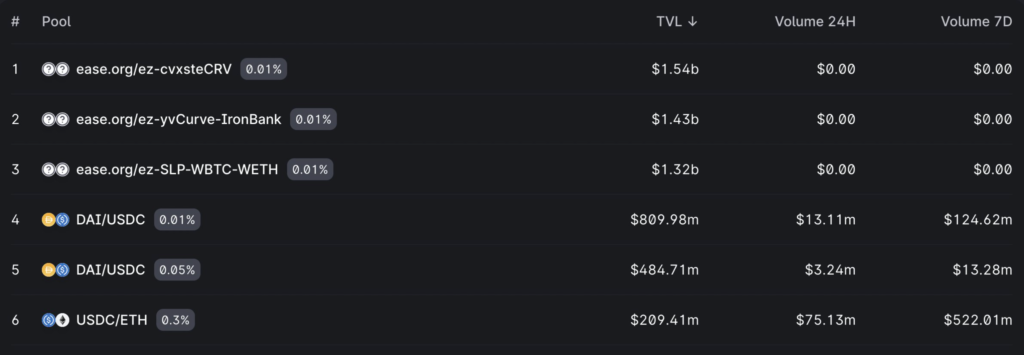

Now, any other liquidity pool we make with this token will have its “Total Value Locked” easily registering up to billions of dollars worth.

All of this is based on the price we declared it to be using the Ease.org/Ethereum pool. We made some new pools with existing Ease DeFi coverage- and yield-bearing Uninsurance tokens (Ez-tokens).

Did this really work?

The proof is in the pudding:

We had the Top3 spots for about a day before Uniswap actively removed them. You can see this commit by Ian Lapham which hides our pools here on Github.

So, interestingly enough, even though Uniswap is a decentralized protocol, what you see on their overview and info pages isn’t.

The pools are still there, we even added a 1.12 trillion example, doubling total Crypto Marketcap, they are just not shown in the rankings.

Don’t trust, verify.

The point of this exercise is to educate DeFi investors and general crypto users. We have easily and clearly shown that you shouldn’t blindly trust TVL.

This Total Value Locked metric is treated as a Gold standard when establishing the legitimacy of DeFi products. But it’s important to understand that it’s quite easy to manipulate these numbers.

You should never take these numbers at face value. A similar type of exploit uses the same method: try and phish users by airdropping “thousands of dollars” in tokens with faked prices.

That’s why, when looking into any token or protocol, ask questions and do the research! Prevent yourself from getting rekt, and DeFi at ease.

Ps: we left out part of this ‘tutorial’ to not make it too easy for the script kiddies out there.