arCore: Smart Cover System (sunsetted)

ArCore is our product that facilitates smart yet simple, dynamic, pay-as-you-grow Nexus Mutual coverage on your funds to protect them against smart contract risks.

Note that arCore has been sunsetted since 1st June 2022. Coverage is no longer valid, any hacks will not be eligible for claims. Users will still be able to withdraw their deposited ETH and earned $Armor rewards. Please see this announcement for full details.

Purchasing Cover

Users may purchase cover for any protocol that currently has enough staked arNFT to support their purchase. For example, if 100 Ether of coverage is currently available for the protocol and 99 Ether is being used for coverage, the user may purchase no more than 1 Ether of coverage. Each of these pools is separated by protocol, so each protocol will have a different amount of coverage available.

Because Nexus Mutual charges different rates for different protocols depending on their risk assessment, the amount that a buyer pays for coverage on each protocol will also differ for the same amount of coverage. A buyer, however, must also pay a premium for the convenience of the system. Current premium multipliers can be found here, and may changed through governance.

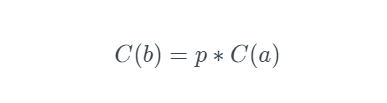

For coverage on a specific protocol:

- C(b) = Coverage cost per second for buyers

- C(a) = Actual current coverage cost per second at source (Nexus Mutual)

- p = Buyer premium for use of the protocol.

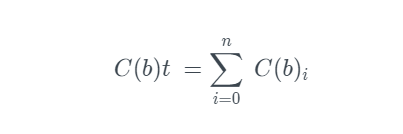

The total cover paid per second is the sum of the amount being paid for each protocol.

- C(b)t = Total amount paid per second by a single buyer for all protocols being protected.

- C(b) = Price paid for protocol.

- n = Number of protocols.

arCore credit

Users will be asked to make a deposit when they first create a coverage plan. The total cost of their plan is streamed from the user’s balance by the second as long as their plan remains constant.

If changes are made, the price per second is updated and a new stream begins (with a set endpoint depending on the balance in the user’s account). The arCore credit can be topped up or withdrawn at any moment.

Note that arCore has been sunsetted since 1st June 2022. Coverage is no longer valid, any hacks will not be eligible for claims. Users will still be able to withdraw their deposited ETH and earned $Armor rewards. Please see this announcement for full details.

Claiming a Payout

If a user loses their funds in a smart contract hack AND if Nexus Mutual claims assessors decide to payout the relevant claims, the user may claim a payout. A successful claim means that the user will be reimbursed the funds that they have a proof of loss for, and limited to maximum of the total coverage they were paying for at the time of the hack.

The affected users are required to submit proof of loss to initiate the claims process; Armor compiles all claims along with proof of loss. (Exception: for old arNFTs that do not require proof of loss, claims can be submitted automatically by Armor without users initiating claims). The Armor system detects and decides on when a hack took place. This will be done through the DAO which determines an exact timestamp for the hack.

Once this timestamp has been submitted, NFTs that have been staked on the Armor contract can be submitted to Nexus Mutual. Nexus Mutual claims assessors will decide whether the claim is valid and if a payout is deserved.

If the claim is accepted and paid out, funds from the payout go to the ClaimManager smart contract, at which point users can withdraw. The system checks to make sure the user had coverage for the hacked protocol at the time of the hack, and allows the user to withdraw the funds that they have proof of loss for.

Note: Nexus Mutual is the underwriter of coverage, and Nexus claims assessors decide all claims. Claims can only be paid out to users if approved by Nexus Mutual claims assessors according to Nexus Mutual policies, terms and conditions.

Note that arCore has been sunsetted since 1st June 2022. Coverage is no longer valid, any hacks will not be eligible for claims. Users will still be able to withdraw their deposited ETH and earned $Armor rewards. Please see this announcement for full details.

Selling Cover

To provide coverage through the arCore platform, we must have sellers staking their arNFTs. These arNFTs are pooled and managed by the system, and buyers may purchase coverage up to the amount that is currently available in the pool for a certain protocol.

Stakers can mint or purchase arNFTs for any protocol and stake them on the arCore contract.

Sellers receive rewards as long as their arNFT is active. For example, if the arNFT has coverage for 1 year, the staker will continue to receive rewards for 1 year. The amount of rewards received over that time is determined by the stakers share in the arNFT pool for that contract.

Source of Revenue

Buyers are charged a premium on top of the true cost of the coverage paid by arNFT stakers. Premium payments will largely be distributed to stakers who originally purchased and staked the NFT yielding a net profit.

The staking rewards are distributed in ARMOR tokens. The revenue earned from buyers is converted into ARMOR tokens and distributed as rewards.

Economics

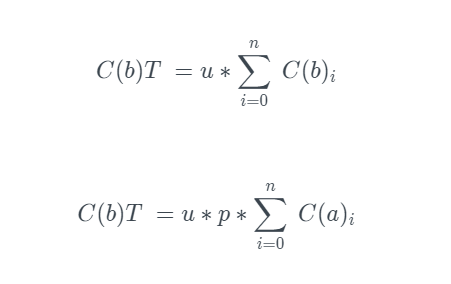

Armor calculates the actual cost of coverage and charges a premium on top for the convenience of using the system. Stakers earn rewards based on their proportional share in the coverage pool. Mathematically (per second) for a specific contract:

- C(b)T = Total coverage cost per second paid by all buyers

- C(a)T = Total actual coverage cost per second at source paid by stakers (total staked)

- C(b) = Coverage cost per second paid by a specific buyer on that contract

- u = Fraction of total capacity utilized (utilization)

- p = premium charge of coverage

- n = Number of users, then

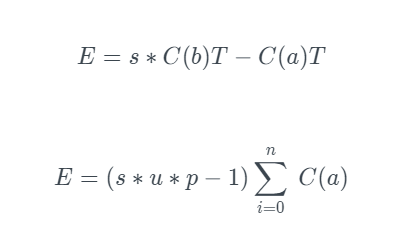

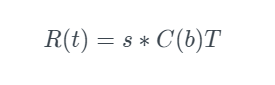

If s represents the stakers fractional share of the revenue, then total earnings per second are given by

- s = share of total revenue given to stakers

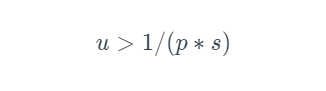

Therefore, earnings will be positive when: At a premium multiplier of 1.5 and share of revenue at 90% (0.9), utilization would have to be >74% to be profitable (considering no farming rewards). The total staking rewards are given by:

At a premium multiplier of 1.5 and share of revenue at 90% (0.9), utilization would have to be >74% to be profitable (considering no farming rewards). The total staking rewards are given by: The staking rewards earned by an individual staker can thus be calculated as:

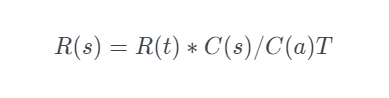

The staking rewards earned by an individual staker can thus be calculated as: where,

where,

- R(s) = Reward earned by a staker on an arNFT per second

- C(s) = Total coverage per second provided by the staker

- C(a)T = Total coverage per second available on the system

- T(s) = Total staking rewards earned per second by the staker

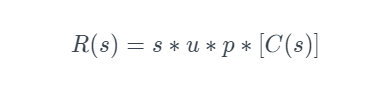

The system is protocol agnostic. Therefore, all rewards (and losses) are distributed proportionally across stakers of all arNFTs. Therefore And thus, the APY can be calculated as:

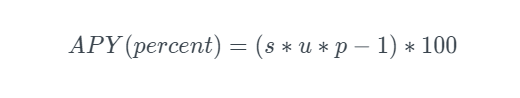

And thus, the APY can be calculated as:

Note: The above APY calculation does not include farming rewards. In reality, actual APY will be higher. This calculation will be updated to yield a more accurate APY shortly after launch as farming stats become available.

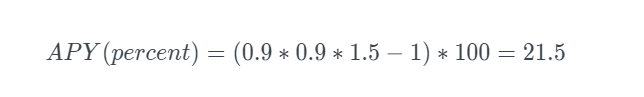

Example 1: arCore has total cover available = $100, and assuming 80% capacity is utilized. Then:

- System utilization = 0.9

- Buyer premium = 1.5

- Stakers shares of profit = 90%

- Total cover available = $100

And, Example 2: arCore has total cover available = $200; assume it is allocated to 50-50 ($100) each to Shield and Shield+ vaults. Assuming Shield+ vault is 100% full and Shield vault is 300% full. Then:Shield+ Vault (Max system utilization capped at u=1)

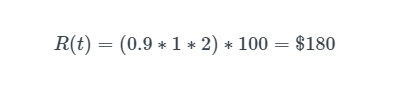

Example 2: arCore has total cover available = $200; assume it is allocated to 50-50 ($100) each to Shield and Shield+ vaults. Assuming Shield+ vault is 100% full and Shield vault is 300% full. Then:Shield+ Vault (Max system utilization capped at u=1)

- System utilization u = 1

- Buyer premium = 200%

- Stakers share of profit = 90%

- Total cover available = $100

And, This means this vault will produce $180 in total rewards for the original $100 cover purchase over the NFT’s lifetime, producing an APY of 80%.Shield Vault (System utilization uncapped; infinite)

This means this vault will produce $180 in total rewards for the original $100 cover purchase over the NFT’s lifetime, producing an APY of 80%.Shield Vault (System utilization uncapped; infinite)

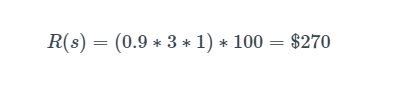

- System utilization u = 3

- Buyer premium = 100%

- Stakers share of profit = 90%

- Total size of staking pool = $100

Then:

This means this vault will produce $270 in total rewards for the original $100 cover purchase over the NFT’s lifetime, producing an APY of 170%.

The total rewards from both vaults = $180 + $270 = $450

Therefore, net APY = 125%

Note that arCore has been sunsetted since 1st June 2022. Coverage is no longer valid, any hacks will not be eligible for claims. Users will still be able to withdraw their deposited ETH and earned $Armor rewards. Please see this announcement for full details.