Lending Protocols

Lending and Borrowing Protocols

Lending Protocols like Aave and Compound provide a valuable service to the DeFi space. See below to learn about how they operate and empower investors to leverage their positions in the market to their fullest potential!

Lending

When cash is in your wallet, it’s readily accessible to you, but doesn’t accrue interest. That’s one reason people use savings account. When you deposit your cash, the bank will use that capital. You will receive some of the interest they gain from that use. It’s a great concept on paper, but in practice, that percent of interest you earn is inconsequential. On average, it’s a 0.06% APY of interest in a savings account in the United States. Meaning, if you had $10,000 in the savings account, after a year you are only earning ~$6 in interest. With that amount of money, you should earn more than that.

A DeFi Lending protocol operates similarly to that savings account. Crypto in your wallet doesn’t accrue interest but putting it into a lending pool will allow the protocol to loan it to other users, accruing your crypto interest. However, where it differs, is that interest rates are dynamic and user focused. Much more goes to the capital supplier. The rates are determined by an algorithm that factors in the ratio of total supply of assets vs assets currently on loan. The greater total supply in use, the greater the interest accrued. Looking to the protocol Aave, if you were to provide your USDC as a borrowable asset, you would earn ~2% APY. Meaning a $10,000 USDC deposit would earn you $200 in a year. A 33x greater return than your average Savings account. Not only is the system completely transparent about how interest rates are calculated, it provides a substantially greater return.

DeFi protocols offer dynamic and transparent interest rate model and provide significantly greater return on yours assets, when compared to a traditional bank. USDC would earn 33x more interest over the year than the equivalent value of USD in an average U.S. Savings Account.

Borrowing

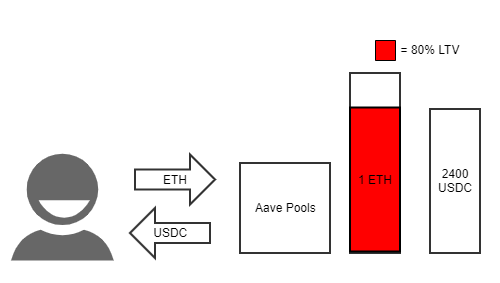

Not only do Lending protocols allow you to lend your assets, you can also take out loans, with interest rates determined by the same dynamic algorithm. Just like with a traditional loan, a loan from Aave is going to require collateral in it’s smart contracts before letting you take a loan. The amount that can be borrowed against your collateral is defined using a Loan to Value (LTV) ratio. An example is provided below:

- Alex deposits 1 ETH (worth $3000 USD) into Aave

- Alex decides to use that 1 ETH as collateral to borrow USDC

- With an 80% LTV, Alex can borrow 2400 USDC, equal to 80% of the value of 1 ETH

From the example above we see that, a user needs to over collateralize any loan that they take out from the ecosystem. Due to the pseudo anonymity provided by the blockchain this provides a disincentive for a user to run off with the loaned assets. Also, the price of ETH is dynamic. What happens if the value were to drop enough that the LTV becomes greater than 80%? This can lead to liquidation.

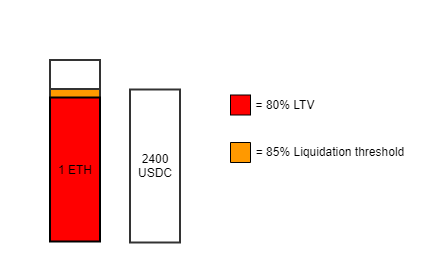

Liquidations

For each borrowable asset, Aave sets a liquidation threshold. If the loan value raises above this value vs collateral, the user is risking liquidation. Let’s expand on the example above:

- USDC has a liquidation threshold of 85%, so Alex’s collateral cannot drop below the value of $2824 USD.

- Alex’s 1 ETH of collateral drops to a value of $2800 USD putting it below the 85% liquidation threshold

- Liquidation is now a risk. If this happens, Alex does not need to return the loan, as the borrowers debt is now paid. But Alex’s ETH is now forfeit.

If you use your deposited assets as collateral, make note of LTV and liquidation threshold, so you don’t run the risk of liquidating your collateral.

Why Borrow?

Automatic liquidation makes it seem like a risky place to borrow against your own asset. So why would anyone do it? To continue the example above lets take a look at Alex:

If Alex thinks the price of ETH will rise in the next year, they would want to hold it for the long term. However, that means the asset cannot be used, or is illiquid. If Alex deposits it as collateral into Aave, they can take out a loan, granting them liquidity without selling ETH. While lending can ensure any investor earns an interest rate on their held capital, a seasoned investor is able to utilize the borrowing to seek out new investment opportunities without selling their original positions. Learn how to make use of your borrowed assets by reading our article on Yield Farming and Aggregators – Yearn.finance