Decentralized Exchange (DEX)

What is a Decentralized Exchange?

A Decentralized Exchange or DEX for short, are the heart of DeFi. Well-known DEXs such as Uniswap, Sushiswap, Balancer, 1Inch, Pancakeswap (BSC), Spookyswap (Fantom) and many, many more allow investors to quickly and permissionless swap crypto assets directly from their personal wallets.

This article will talk about how a DEX operates and differs from its traditional sibling, the Centralized Exchange or CEX. See this article for more information on CEXs.

Rather than having a traditional business structure, and operating the exchange platform on their own servers, a DEX operates directly on the blockchain. The most common form of DEX is an Automated Market Maker (AMM). A system where the smart contracts control the liquidity directly on-chain. With power not centralized to one place or entity, this allows for:

- No KYC requirements

- Full ownership of user’s assets

- Non-discriminate listing procedures

- Minimal trading fees and no withdrawal fees

Let’s take a look at each in detail:

No KYC Requirements

Since a DEX doesn’t exist in any physical place, mainly being programmed and stored on the blockchain, there are no regulatory requirements exerted on them by governmental bodies. A user only needs a crypto wallet and they can connect directly to the smart contracts and start trading immediately.

Full ownership of Assets

DEXs interact directly with a user wallet. There is no DEX-specific account you need to access. When trading assets you do so directly from your personal wallet, so the user always has 100% control of their funds.

Non-discriminate listing procedures

No single-entity controls a DEX. This allows users to list tokens without the need for a lengthy requirement process. This method exposes users to the full protocol ecosystem DeFi has to offer.

Minimal Trading Fees, No withdrawal fees

DEXs require minimal overhead. This allows users to trade with incredibly minimal trading fees. With users trading directly from a personal wallet, you never have to worry about being hit with a high withdrawal fee either.

Now that we’ve covered some of the basic benefits, let’s dive into the most unique aspect of DEXs – Liquidity Pools (LPs).

Liquidity Pools – The lifeblood of a Decentralized Exchange

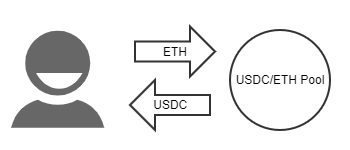

Liquidity pools are a pool of tokens (usually a pair) that are deposited into, and which are controlled by a smart contract. This allows trading from one token in the pool to the other. This is the basis of how DEXs operate. A swap must occur through one of the many LPs on the system, sometimes using multiple LPs to achieve the desired token to token transfer. Lets put forth a simple trading example:

- Alex has ETH but wants to trade for USDC

- Connecting their wallet to the DEX, they initiate a swap transaction

- The DEX has a USDC/ETH pool, so;

- Alex adds ETH to the smart contract

- The Smart contract then sends the equivalent value of USDC back

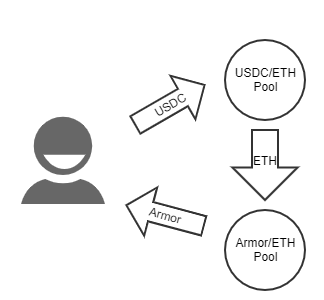

This happens automatically through the system’s programming, and the funds are immediately available to Alex on transaction completion. Sometimes, a pair doesn’t exist for a token, so it needs to move through multiple LPs for the desired swap. Let’s take a look:

- Alex has USDC and wants to trade for Armor tokens

- Connecting their wallet to the DEX, they initiate a swap transaction

- The DEX doesn’t have a USDC/Armor pool but does have USDC/ETH and ETH/Armor pools.

- The user simply chooses to swap their USDC to Armor on the front end. Meanwhile, in the background the DEX is making the swap USDC > ETH > Armor.

Now an important question to answer is where does this liquidity come from? The answer is Anyone! Any user that wishes to provide liquidity can connect their wallet and contribute to a token pair. The users who do so will earn trading fees in proportion to their total contribution to the pool. For more information on LP-providing, see our article on Liquidity pools.

DYOR about Decentralized Exchange risks:

While DEXs are a pillar of the DeFi ecosystem they are not without their risks. It’s important to note:

- The lack of listing restrictions allows any token, even scams (fake tokens) to make pools. Fake tokens can have the same name as real tokens. Also, projects that might look legit, can have tokens that can be bought, but never sold, etc.

- DEXs are only as secure as the individuals who coded them, your funds stored in LPs can be exposed to smart-contract risks and even get lost in the event of a hack or exploit.

- While trading fees are substantially lower, always factor in the networks fees associated with executing transactions on the blockchain. On the Ethereum network, these can be quite high at times, especially in the case of hacks, when everyone at once wants to swap their tokens. Also: with volatile token pairs, a swap will only succeed if the exchange rate hasn’t changed much between initiating and confirming the ETH transaction (as is the case on any other chain).

- Though there might be an available pair to swap, if there isn’t enough liquidity, then a swap can incur a lot of slippage, meaning you will get much fewer tokens in return than you might have expected based on the exchange rate alone.

The above is meant to emphasize one of the core tenets of DeFi and crypto at large: Do Your Own Research (DYOR). Informed decisions will mitigate most risks from scams and phishing attempts. Finally, adding your assets into an ease RCA vault will cover your assets from hacks. Allowing you to DeFi with Ease.

See also the Centralized Exchange, or CEX, which are discussed in this separate article.