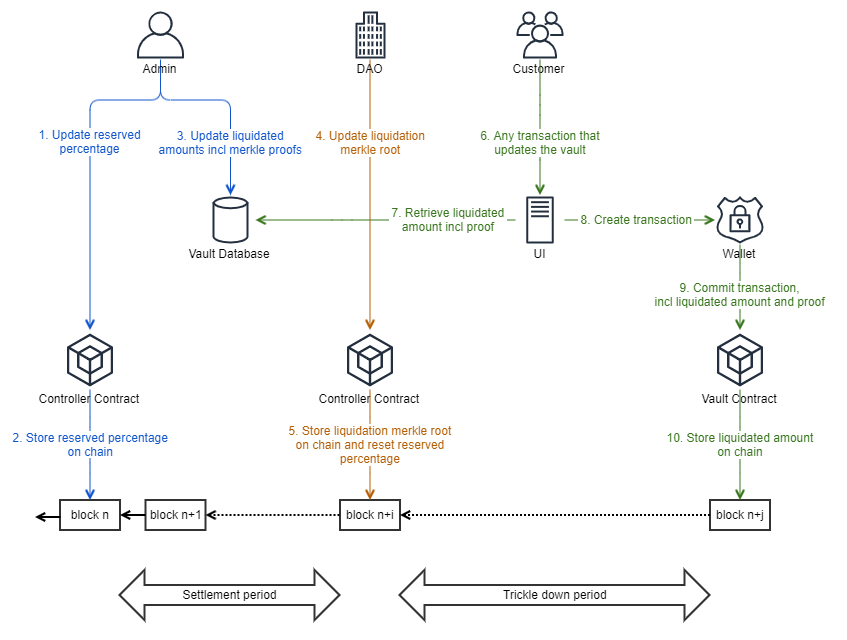

Liquidation Procedures

This is an outline of the process that occurs in the event of a hack, when a partial amount of each vault must be liquidated to distribute loss proportionally through the Ease ecosystem.

Settlement Period

When a hack occurs on-chain that affects one of the assets in the ecosystem, the vaults undergo a settlement period.

- The RCA Guardian, or Admin, sets a single reserve percentage for all vaults. This reserves a maximum amount for each vault to be liquidated later. This value is typically a higher percentage than the actual liquidated amount. This is to discourage users from attempting to exit the ecosystem before the settlement period resolves.

- This Reserve value is sent to the contract in control of the uninsurance vaults and is now stored on-chain and reflected in the dapp.

- Admin publishes the actual liquidation values for each vault and stores in the off-chain database.

- The DAO votes to approve these liquidation values for each vault.

- If the vote passes, the liquidation values are updated on-chain through the controller contract. This process resets the reserves percentage to zero and marks the end of the settlement period.

Trickle Down Period

After the liquidation values are decided and published on chain those percentages are now posted to sale through the dapp.

6-10. Now liquidated portions of each vault are up for sale. Users may now interact with the vaults through the Buy liquidated asset function. During the execution of this function, the liquidation values of each vault will update after each buy function from a user until the Liquidation value for the vault reaches 0. Once every vault reaches a liquidation value of 0 the trickle down period ends. And users who suffered a loss from the hack may call the event payout function to be reimbursed for their lost assets in an equivalent value of Ether.