arNXM v2 Documentation

This is the updated arNXM v2 documentation. Some arNXM v1 documentation is still relevant. See arNXM v1 for more information.

Lockup Periods

Currently, unstake requests have a 30 day cooldown before funds can be withdrawn. With Nexus v2, a ve lockup model is being adopted. Now NXM will be required to be locked up for quarterly intervals, ranging from 90 days to 2 years. The lockup period determines the length of cover available for purchase, as well as the cut of rewards a staker receives.

To ensure arNXM depositors generate a large amount of yield, and support a wide range of cover durations for Nexus policy holders, the NXM will be locked up under the following distribution pattern. NOTE: The distribution is subject to change at any time.

| Lock Periods | |

| unlocked | 5.00% |

| 3 mths | 20.00% |

| 6 mths | 25.00% |

| 9 mths | 25.00% |

| 12 mths | 15.00% |

| 15 mths | 10.00% |

Withdrawals

5% of all NXM managed by arNXM will remain unlocked to provide withdrawal liquidity. If a withdrawal exceeds this value, the following backup contingencies are available:

- A depositor will have to coordinate with Ease to withdraw on the next quarterly interval

- Selling of arNXM on the open market.

- Selling of the NXM staking NFT to recover funds for users.

- As Nexus’ v2 model has not yet launched it is currently unknown the nature of the Nexus NFT market that will exist. So the viability of this method is not yet known.

Staking

With Nexus v2 comes a more fluid method of staking management. Ease will operate a series of 3 syndicates that will have arNXM users assets distributed through. These syndicates will cover protocols based upon a risk rating assigned through our own Risk Rubric. For the entire rubric, see the documentation here.

With ratings assigned protocols will be placed in one of the 3 buckets

- The AAA Bucket

- The AA Bucket

- The A and Surge Bucket

Each bucket will cover protocols based on their risk rating.

Price Increases and Rating Decreases

Leverage Increases as Rating Decreases

| AAA Bucket | AA Bucket | A & Surge Bucket* | |

| arNXM Allocation | 75% | 25% | TBD |

| Rating | 100-70 | 100-60 | 100-50 |

| Target Price | 1.0-1.6% | 1.0-3.4% | 1.0-4.7% |

| Leverage Used | 1-10x | 5-15x | 10-20x |

*Bucket will not be live on launch

Pool 1: The AAA bucket

This pool will consist of only the highest rated protocols, the cut off being a Risk score of >= 75. These protocols will have the cheapest target prices for premium costs (<1.6%). These protocols generally are the “least risk” to underwrite, and historically utilized high capacity (though that is no longer the case for some). The small pool of protocols means that maximum leverage is not needed to support this bucket. Returns will be safer for stakers as the risk of a potential coverage event is lower.

Pool 2: The AA bucket

This bucket will contain protocols between the 75-60 threshold. These protocols will have the target prices for premium costs between 1.6% and 3.4%.

It is unlikely that the full weight of user stakes will be used on the protocols, as cover demand is consistently lower for most of these. But more NXM leverage will be used to cover the wide range of protocols, as the AAA bucket will be rolled into this one.

Pool 3: The A and Surge bucket

This bucket will be much more dynamic and likely use full leverage on the protocols to maximize capacity with the least amount of arNXM possible. It will include protocols within the 60-50 threshold, as well as higher rated protocols that begin to experience capacity issues.

Leverage and Weight

Nexus allows a maximum of 20x Leverage for stakeholders using NXM to underwrite protocols. Only 1x weight can be applied per protocol, so that a single protocol cannot be overleveraged from the underwriting capital. Our buckets will utilize varying amounts of leverage and weights per bucket.

Leverage will be determined by bucket, with the A bucket using the most leverage and the AAA bucket using the least. Users willing to stake into higher risk buckets will also gain the benefit of higher rewards, from maximizing leverage across covered protocols.

Weight per protocol is determined through historical demand by policy holders for each protocol. We track Nexustracker.io cover data to determine the best weight value to use. The goal is to provide enough capacity to cover demand, but not have excess capacity sitting unused. Unused capacity, means unnecessary leverage and unnecessary risk.

Update Timeline

Chosen protocols and their ratings will be revisited on a monthly timeline, or in response to a claims event. During an update the management pool is subject to the following changes:

- Adjustment of staking weights

- Adjustment of total leverage throughout the pool

- Adjustment of Protocol Rankings, and therefore the target price (premiums).

- Adjustment of total # of covered protocols.

Staking Weights

Staking Weights are determined on a per protocol basis. The major factor for this is historical demand for the protocol’s recently expired and active policies. Weights will be revisited on the monthly basis, or in the event of a sudden surge of demand for protocols within the AAA bucket only.

Total Pool Leverage

Leverage used in the pool will be revisited on a monthly basis. The three bucket system used by Ease (as seen in the risk rubric) already determines the general expectation of leverage for each bucket. This value will not fluctuate greatly.

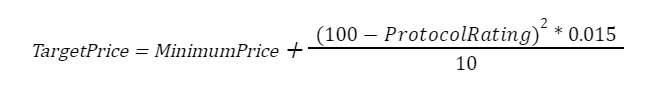

Protocol Ratings (Target Price)

Protocol Ratings are determined by our Risk Rubric, as seen here. We will update these ratings on a monthly basis, or do spot updates in lieu of adverse events. With the change of rating, comes a change in target price, or the lowest possible price of coverage our syndicate offers for that protocol. This change will not have an immediate impact on price due to how v2 operates. See Nexus v2 Documentation for more info.

# of Covered Protocols

While Ratings will determine the target price and what syndicate tier the protocol falls under, that won’t always correlate with demand. Protocols may be added to lower tiers if more capacity is required. Protocols will never be added to a higher tier, for example:

Protocols in the AAA Syndicate could be added to the AA and A syndicates to help open up more capacity. But, a Protocol ranked for the AA Syndicate could only be added into the A syndicate, and not the AAA syndicate.

Protocols can also be removed if there is no policy demand for the capacity that is being provided.