What are bribes and leases?

Bribes ($EASE)

Protocols and Whales can buy and offer $EASE tokens as a bribe for $gvEASE holders to stake onto their desired vault. This reduces that vault’s max fee.

A protocol interested in lowering their vaults max fee can thus purchase $EASE and use it as a bribe to pay $gvEASE holders who might already have max voting power to stake into their system. This is more beneficial in the short term, vs the protocol needing to deposit $EASE themselves for 1 year to achieve the same voting power.

The bribe amounts can be freely chosen and fixed for a number of weeks. This way, Protocols and large DeFi stakers could possibly buy extra protection against costs in case of a hack cheaply.

Note:

DAO voting is ineligible for the bribing mechanism. So, the $gvEASE is obtained with the bribe and that $gvEASE is then automatically staked on the chosen protocol to lower the fees in case of a hack. The bribed $gvEASE can not be used by the protocols to vote on proposals.

Read more about how to offer bribes here on the Knowledge Base.

Leasing ($gvEASE)

The other side of the trade is the Lease. Users with $gvEASE can stake themselves on vaults they participate in. But if they don’t have any holdings or their vaults already have a low max fee, then they can lease their token out to users who have active bribes.

The Leasers then receive a weekly cut of the bribes offered in $EASE tokens, in return for losing the staking power of the leased $gvEASE.

Read more about how to lease your $gvEASE for bribes here on the Knowledge Base.

The $EASE Reward Distribution Model

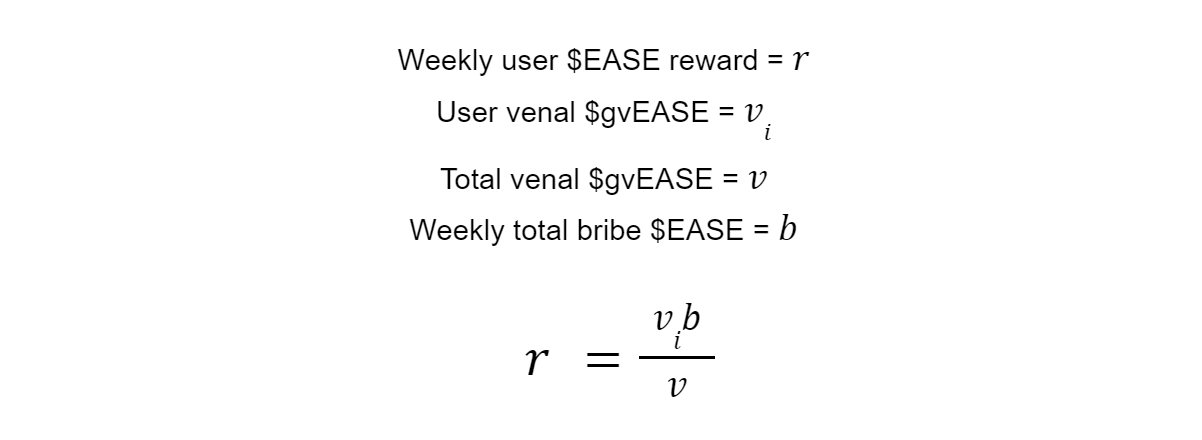

There’s a venal pot of $gvEASE tokens and a bribe pot of $EASE tokens. Each percentage share of the weekly bribe pot gets the same percentage share of the venal pot that is staked, and each share of the venal pot gets the same share of the bribe pot in rewards.

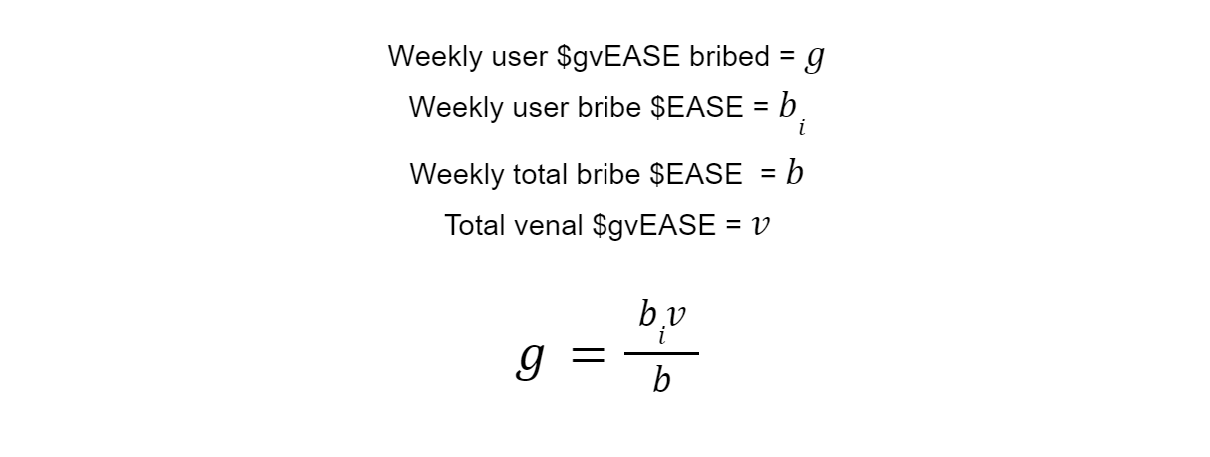

The opposite is true for the other side of the system. The percentage share of all $gvEASE in the venal pot that a user is awarded is equal to the percentage share of the user’s $EASE bribe compared to all bribes.

For example, let’s say there are current “subscriptions” of 100 $EASE tokens being paid for bribes each week, and there are 10,000 $gvEASE available for bribes. That means that each week a briber can pay 1 $EASE for 100 $gvEASE staking power. A seller can profit 1 $EASE for every 100 $gvEASE they put up for bribes.

If next week more people want to purchase bribes. The bribe pot may raise to 200 $EASE weekly, therefore making it twice as expensive to bribe and twice as profitable to sell stakes for bribes.

This system allows the cost of bribes to constantly adjust to their perceived value because cost changes based on supply and demand.