Functionality of the Ease Dapp

Note that this is a functional description only. For an in-depth and step-by-step tutorial on how to actually use the Ease Uninsurance app, please see this knowledge base article here.

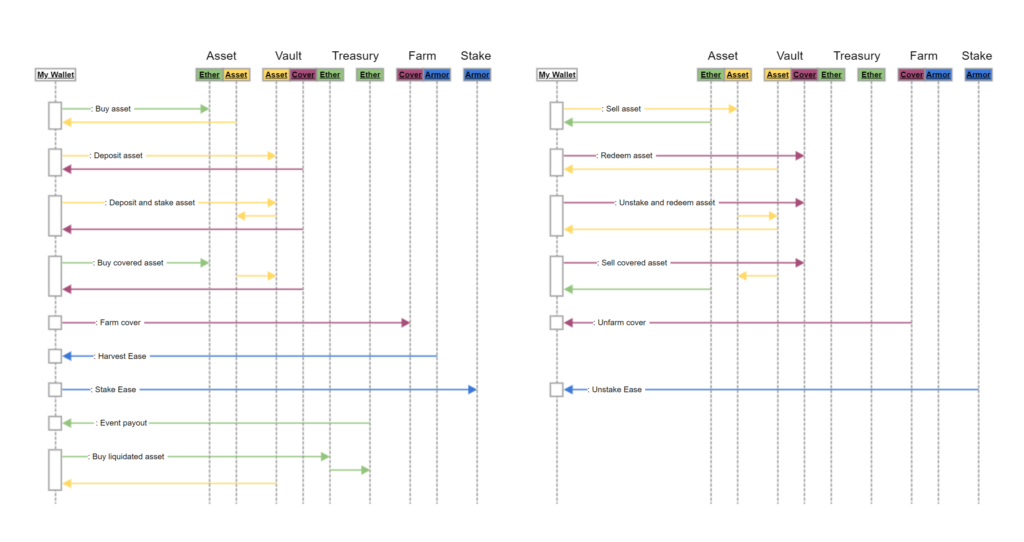

After connecting your wallet to the dapp you will have a variety of options in how you decide to interact with the Ease ecosystem. Each option shown above is outlined below.

User Actions

Deposit Asset: Deposit the underlying asset in to its uninsurance vault and receive the Ez-token equivalent back.

Redeem Asset: Return your Ez-token to the unisurance vault to receive your underlying asset back to your wallet.

Buy Covered Asset: Spend ether to receive the underlying asset routed into the Uninsurance vault. You will receive the Ez-token equivalent into your wallet.

Deposit & Stake Asset: Deposit the underlying asset into its uninsurance vault and the vault will automatically stake the asset if eligible. You will receive the Ez-token equivalent into your wallet.

Unstake and Redeem Asset: Return your Ez-token to the uninsurance vault to receive your underlying asset back to your wallet. If the asset was eligible it will be unstaked automatically by the system.

Event Payout: In the event of a hack, some of your underlying assets will be lost or devalued. Receive the payout equivalent to a majority of your loss.

Buy Liquidated Asset: After a hack occurs, part of each vault is liquidated to cover the loss in the ecosystem. Purchase liquidated assets directly from the uinsurance ecosystem for Ether and receive the uncovered asset into your wallet. See Liquidation Procedures for more information.

Farm Cover (not implemented yet, planned for V2): Stake your Ez-token into the Ease farming contract. This will allow you to earn an %APR in Ease while staked. See Farming Rationale for more information.

Unfarm Cover (not implemented yet, planned for V2): Unstake your Ez-token from the farming contract to receive it back into your wallet

Harvest Ease: Receive the earned Ease from the farming contract into your wallet. Or the rewards can auto-compound by redepositing the rewards.

Stake gvEase: Stake gvEase to the corresponding Uninsurance vault. This stake determines a vaults safety ranking. See here for Safety Ranking rationale.

Unstake gvEase: Unstake your gvEase from an uninsurance vault to receive it back into your wallet. This will affect the vaults safety ranking.

Glossary of terms

Uninsurance Vault: The smart contracts that make up the ease ecosystem, these smart contracts store underlying assets and mint Ez-tokens to the user as a receipt of ownership upon deposit.

Underlying Asset: The token that a user stores into an Ease uninsurance vault

Ez-token: The token that a user mints and receives for depositing an underlying asset into an Ease uninsurance vault

Liquidated asset: The portion of underlying assets that are sold to users to recover assets lost to a hack.

$gvEase tokens: See the gvEase announcement here.